Description

List of 3 large European food focused private equity funds

The European food industry is undergoing significant changes. Many consumers are moving to a plant-based diet, organic food is getting increasingly important, as well as new farming methods like vertical farming are getting traction in the market. On the other hand, traditional food companies are working on keeping up with the digitalization and modern, efficient production methods. Several large European private equity funds are active investors in the food and beverage field. We are introducing you to three firms from our list.

1. Argos Wityu (Brussels, Belgium)

The European private equity firm Argos Wityu has offices in France, Brussels, Frankfurt, Luxembourg, Milano and Geneva. In total, the firm manages more than €1.4bn and mainly acquires majority stakes between €10-100M. Argos Wityu is specialized on MBO and MBIs, spin-offs as well as growth capital. One of the main investment verticals is the food and beverage sector. For instance, Argos Wityu invested in Latteria e Caseificio Moro, a market leader for cheese products in Italy.

Update 2024: At the start of 2024, PI Services was acquired by the Coexa Group, which is majority-owned by the British private equity firm Argos Wityu. PI Services provides consulting, integration services for Microsoft Cloud infrastructures, and infrastructure operation solutions.

2. PAI Partners (Paris, France)

The origins of PAI date back to 1872. Today, the firm belongs to the leading European private equtiy firms with €26.4bn asstes under management. One main area of PAI is the “Food & Consumer” vertical. One recent investment is Austrian ingredient manufacturer NovaTaste. Another investment of PAI’s mid-market fund is French frozen dessert manufacturer “La Compagnie des Desserts”. Also US-based Tropicana Brands Group is part of the portfolio.

3. Rabo Investments (Utrecht, Netherlands)

The Dutch private equity investor Rabo Investments is a subsidiary of well-known Rabobank. The firm invests in growth capital, private eqity as well as food & agriculture-focused funds. Hence, Rabo Investments is an active food-focused private equity investor. One exemplary investment is V&S Foodspecialist, whcih is focused on frozen snacks, like finger food, plant-based products and appetizers.

Picture source: Brenda Godinez

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds helps to get in touch with the executives and investment managers of the included firms.

Picture source: Emile Perron

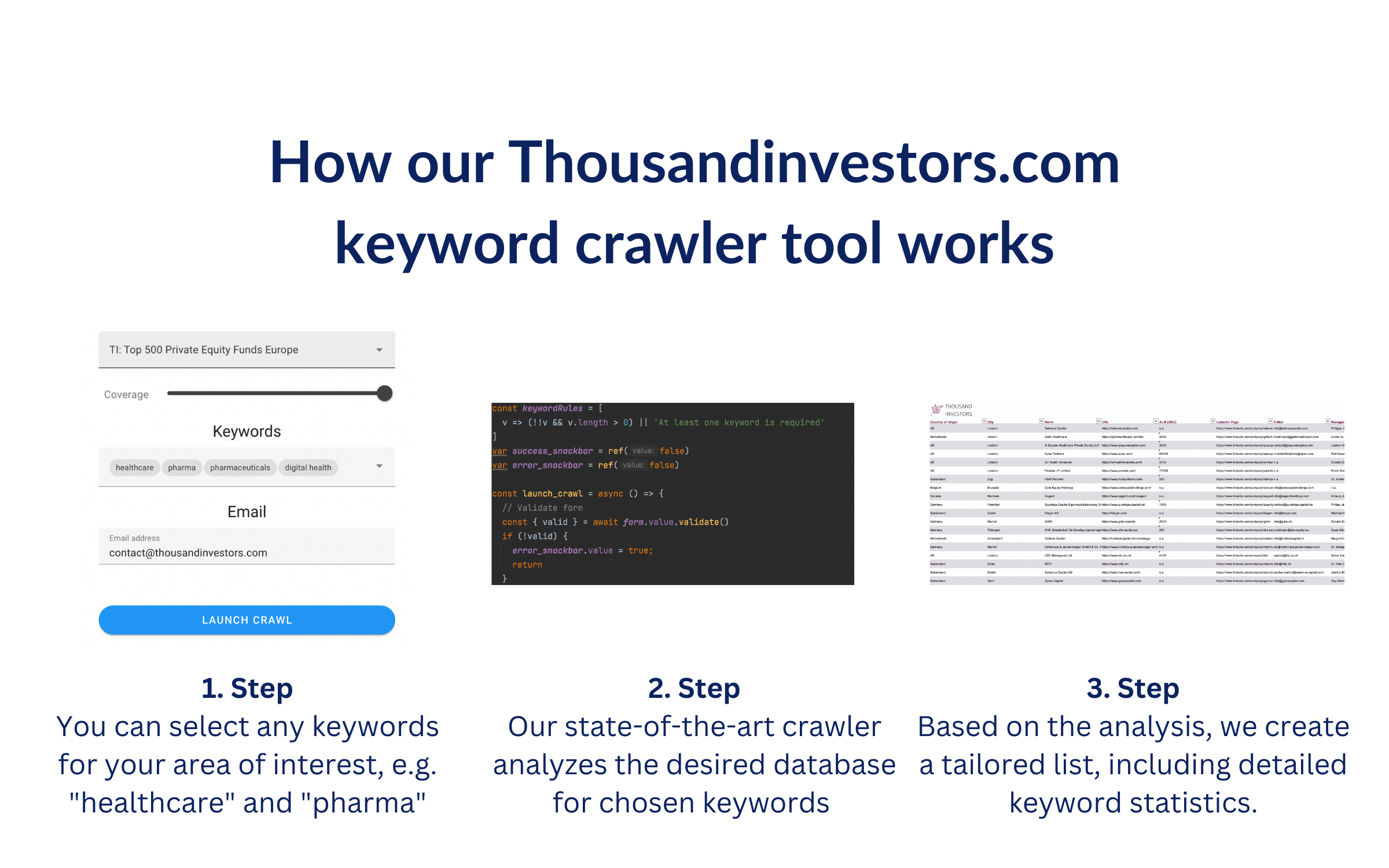

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “food”, “foods”, “groceries”, “nutrition”. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords where found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 250 largest Food Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Food-and-Beverage-Private-Equity-Investors.png)

![List of the 50 largest Climate Tech Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Climate-Tech-Private-Equity-Investors.png)

![List of the 30 largest Private Equity Funds in Belgium [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Belgium.png)

![List of the 60 largest Industrial Technology Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Industrial-Technology-Private-Equity-Investors.png)

![List of the 300 largest Buy-Out Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Buy-Out-Private-Equity-Investors.png)

T. Maier (verified owner) –

Very current data at a fair price. I will buy from Thousandinvestors again