Description

List of 3 large European infrastructure focused private equity funds

Infrastructure investments can be – amongst others – pursued in airports, railroads, telecommunication networks, distribution grid operators as well as pipeline providers. European private equity firms are active investors in the infrastructure field. In the following, we are highlighting three investors from our list.

1. Arcus Infrastructure Partners (London, UK)

The London-headquartered private equity manager arcus focuses on European infrastructure assets. These assets could be either located in the telecommunication, transport or energy field. The firm has €8.3bn assets under management. One exemplary portfolio company is Alpha Trains, a train leasing company operating in 17 countries. Arcus invested in 2008 in Luxembourg-based infrastructure company Alpha Trains. Arcus also invested in telecommunication infrastructure company Swiss4-net, which provides fibre-to-home networks in Switzerland.

Update 2024: In December 2023, the private equity company Arcus Infrastructure Partners announced its acquisition of IPHH Internet Port Hamburg a leading regional datacentre operator and internet service provider.

2. 3i Group (London, UK)

3i belongs to the most important private equity managers in Europe. Besides private equity, 3i is actively investing in “economic infrastructure” and “greenfield projects”. The firm targest GBP50-400M infrastructure investments, for instance in network infrastructure, water, electricity gas, pipelines, hospitals and rails, roads, airports and ports. For instance, 3i invested in Belfast City Airport, pipeline provider East Surrey Pipeline or German telecommunication infrastructure firm DNS:NET.

3. EQT (Stockholm, Sweden)

Also Swedish private equity firm EQT is a major investor in European infrastructure companies. The firm runs a “Value-Add Infrastructure” strategy, as well as an “Active Core Infrastructure” strategy. In both verticals, EQT is investing €500-100M per deal. Portfolio companies include Deutsche Glasfaser, EdgeConneX, Cypress Creek or Colisee.

Picture source: Unsplash+

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds helps to get in touch with the executives and investment managers of the included firms.

Picture source: Emile Perron

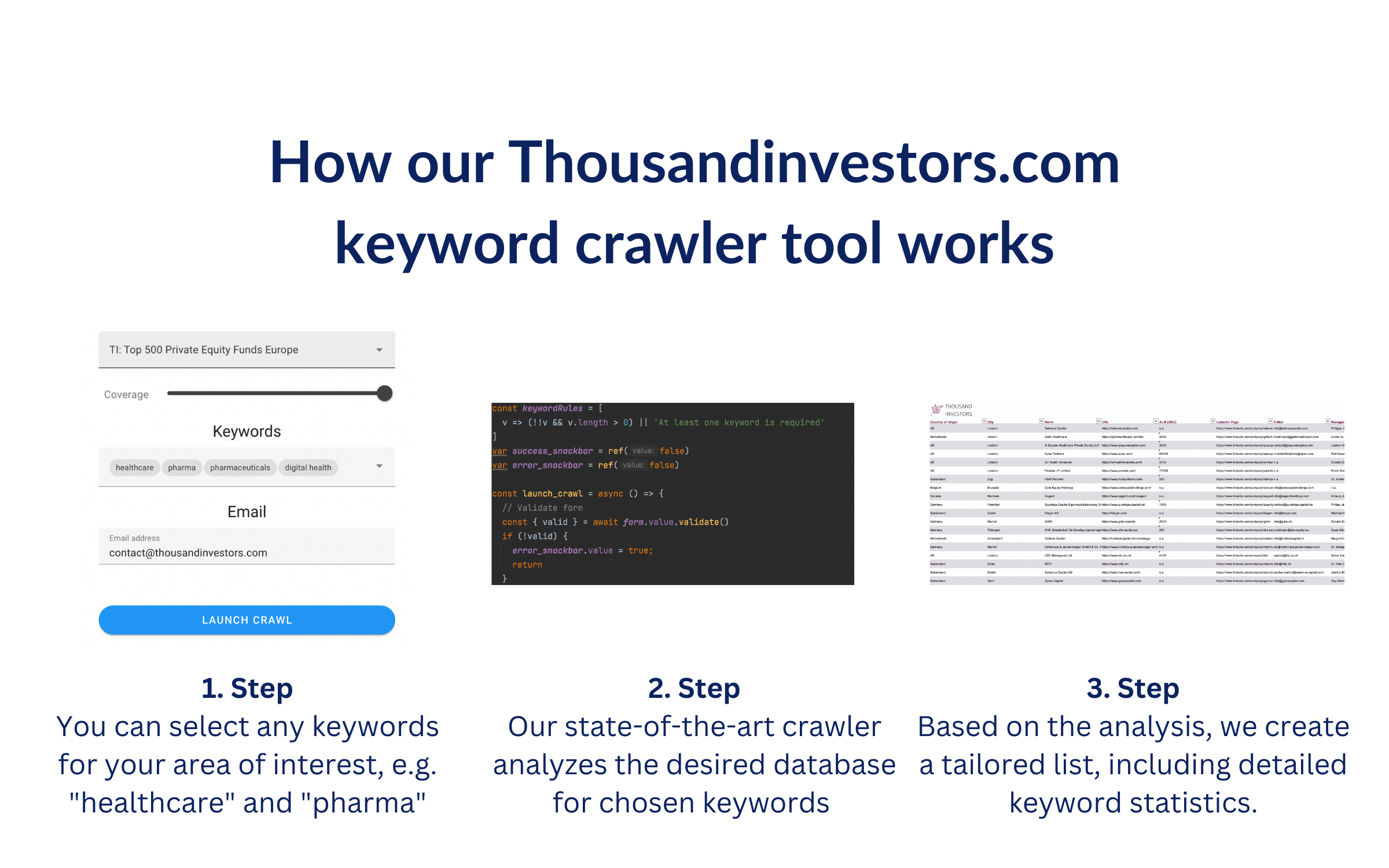

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “infrastructure”. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords where found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 300 largest Infrastructure Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Infrastructure-Private-Equity-Investors.png)

![List of the 60 largest Private Equity Funds in Luxembourg [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Luxembourg.png)

![List of the 60 largest Industrial Technology Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Industrial-Technology-Private-Equity-Investors.png)

![List of the 50 largest Climate Tech Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Climate-Tech-Private-Equity-Investors.png)

![List of the 300 largest Buy-Out Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Buy-Out-Private-Equity-Investors.png)

Margarete Hansen (verified owner) –

Slim data set with all relevant information, very helpful!