Description

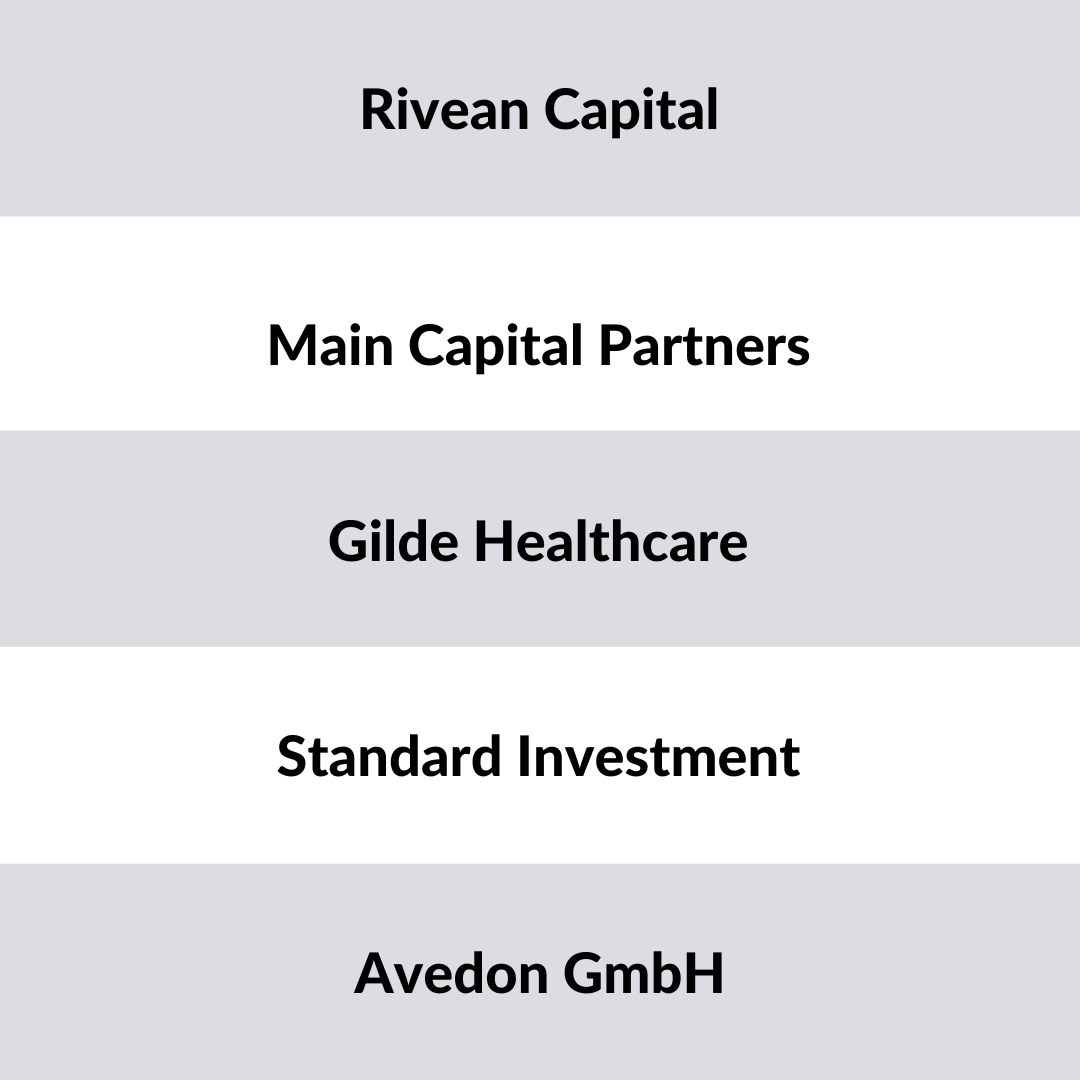

List of 3 large Private Equity Funds in the Netherlands

Private equity funds in the Netherlands play a significant role in the country’s investment landscape, driving economic growth and supporting the development of businesses across various industries. These funds pool capital from institutional investors, high-net-worth individuals, and other sources to acquire and invest in privately held companies. Private equity funds in the Netherlands typically focus on different stages of a company’s lifecycle, including early-stage venture capital, growth equity, and buyouts. This hand-curated list is based on our list of the 500 largest private equity funds in Europe. In the following, we are introducing you to three investors from our list.

1. Rivean Capital (Amsterdam)

Rivean Capital was founded in 1982 with a vision to provide financial solutions. The companies investment philosophy is centered around long-term partnerships and sustainable growth. The firm places great emphasis on responsible investing and promoting environmental, social, and governance practices. In addition, Rivean Capital actively supports portfolio companies such as Corilius, with strategic guidance, operational expertise, and access to a vast network of industry connections. Currently, the company manages around €3Bn assets.

Update 2024: In 2023, the Dutch private equity company Rivean Capital relocated its office in the Netherlands to Amsterdam. The company’s rebranding aims to reflect its forward momentum, which is also reflected in its move to the 2Amsterdam building.

2. Main Capital Partners (Antwerpen)

Main Capital Partners is an investment firm specializing in the software and technology sectors. With a strong presence in Europe, the company focuses on supporting and accelerating the growth of innovative software companies. Main Capital adopts an active and hands-on approach, working closely with management teams to develop strategies and capitalize on market opportunities. The investment portfolio of Main Capital consists of a diverse range of software companies across various verticals, including fintech, healthcare, e-commerce, and business software. One of their companies, for example, is EuroTracs, who build fully cloud-based software products.

3. Gilde Healthcare (Utrecht)

Gilde Healthcare is a leading European investor in the healthcare sector, focusing on innovative companies in the biotech, medtech, diagnostics, and digital health spaces. With a history spanning over two decades, Gilde Healthcare has established a strong track record of supporting companies at various stages of their growth. Portfolio companies include Novicare, a company that offers nursing homes the possibility to outsource their (para)medical staff, and Ace Pharmaceuticals.

Columns included in our list

Through our list, you can get an overview of the most important private equity investors in the Netherlands. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds helps to get in touch with the executives and investment managers of the included firms.

Picture source: Azhar J, redcharlie | @redcharlie1

![List of the 40 largest Private Equity Funds in the Netherlands [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Netherlands.png)

![List of the 90 largest Buy-and-Build Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Buy-and-Build-Private-Equity-Investors.png)

![List of the 30 largest Private Equity Funds in Belgium [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Belgium.png)

![List of the 300 largest Healthcare Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Healthcare-Private-Equity-Investors-1.png)

![List of the 190 largest Private Equity Funds UK [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-UK.png)

Reviews

There are no reviews yet.