We wrote this article while researching for our list of the 700 largest biotech startup focused venture capital funds. The list can be downloaded with a few clicks and includes the most relevant investors for biotech startups. We identified the included funds based on our sophisticated crawler technology and manual research.

Qbic Fund’s Commitment to Biotech Startups

Qbic, an inter-university venture capital fund based in St-Denijs-Westrem, Belgium, has made a significant impact on the biotech startup scene. With a clear strategy of transforming technological breakthroughs into sustainable businesses, Qbic has been actively investing in promising biotech ventures that show potential for substantial growth and societal impact.

Investment Strategy and Focus

The investment strategy of Qbic is centered around seed and early-stage funding, specifically targeting spin-offs or startups that originate from its knowledge partners. This includes universities, research institutes, and hospitals across Belgium. The fund has shown a strong preference for companies that are either a knowledge partner spin-off, founded on technological innovations from these institutions, or startups with robust R&D collaborations with one of Qbic’s knowledge partners.

Notable Biotech Investments by Qbic

Qbic’s portfolio boasts several biotech companies that have received the fund’s backing. For instance, AmphiStar is working on biosurfactants for developing sustainable products while Obulytix is at the forefront of creating next-generation enzyme-based antibiotics. THERAtRAME is another standout in their portfolio; it focuses on therapeutics targeting tRNA epitranscriptomics in cancer treatment. These investments highlight Qbic’s commitment to HealthTech and Biotech sectors which are integral parts of their investment focus.

Geographical Reach and Portfolio Diversity

Though based in Belgium, Qbic’s influence extends beyond its geographical boundaries through its support of companies like Animab which develops antibodies to tackle gastrointestinal pathogens in livestock – showcasing not only geographical reach but also diversity within the biotechnology sector.

The Impact of Qbic Fund Investments

Beyond financial support, Qbic fund takes pride in contributing to impactful advancements in healthcare. Their investments have led to job creation and potential benefits for over 500 million patients worldwide. Moreover, they actively work with management teams post-investment to improve ESG ratings within their portfolio companies – believing this drives long-term value creation.

Supporting Female Leadership and Sustainable Development Goals (SDGs)

A notable aspect of Qbic’s impact is its support for female CEOs within its portfolio companies – accounting for 32% – as well as the alignment with 12 UN SDGs including zero hunger, good health and well-being, gender equality among others.

The Team Behind the Investments

The team at Qbic comprises industry experts with extensive experience in venture capital and a shared passion for nurturing technological innovation into successful enterprises. The team’s diverse background ensures comprehensive support for startups throughout their growth journey.

In Conclusion: A Catalyst for Biotech Innovation

To sum up, Qbic Venture Partners have positioned themselves as catalysts within the biotech startup ecosystem. Through strategic investments focused on sustainability and innovation originating from academic research institutions, they continue to boost breakthroughs that could shape a better future for global health care systems.

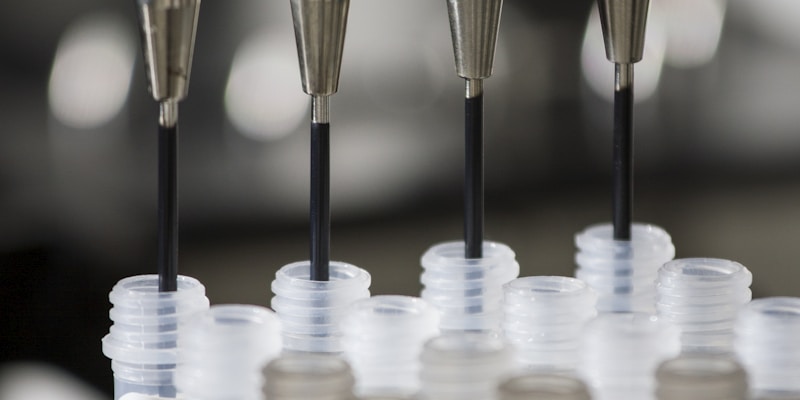

Picture source: National Cancer Institute