Description

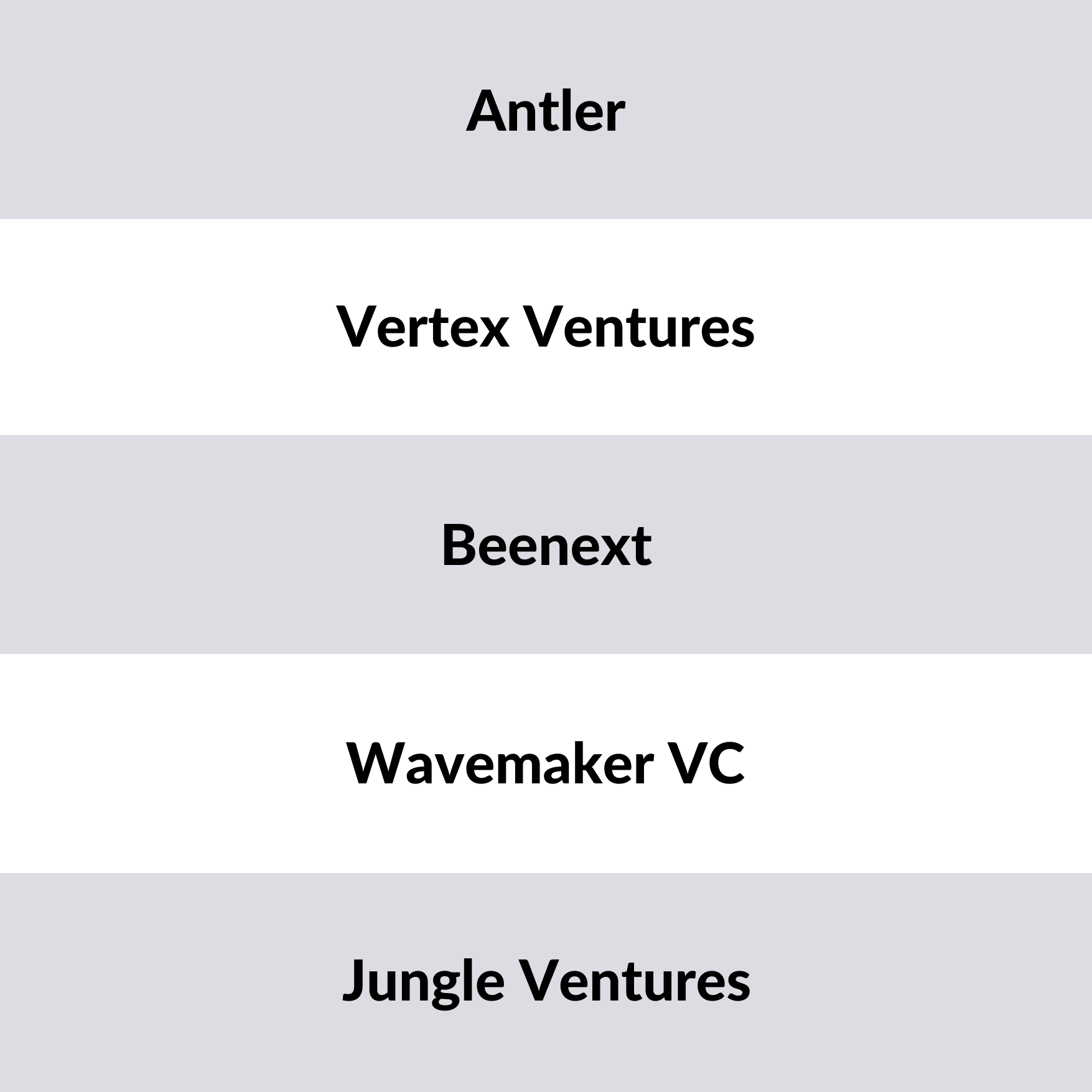

List of 5 large venture capital investors from Singapore

Singapore is home to some of the most influential venture capital firms, driving innovation and supporting early-stage startups across various industries. These firms play a critical role in the region’s growing digital economy, particularly in Southeast Asia and India. With a strong financial ecosystem, strategic global positioning, and access to talent, Singapore-based VCs continue to be key enablers of startup success. The following list highlights five of the top venture capital investors in Singapore, showcasing their investment focus and links to their websites, as included in our list.

| Name | URL | Focus |

|---|---|---|

| Antler | https://www.antler.co/ | Early-stage |

| Vertex Ventures Sea & India | https://www.vertexventures.sg/ | Consumer, enterprise, fintech, healthcare/agritech |

| Beenext | https://www.beenext.com/ | N.A. |

| Wavemaker VC | https://wavemaker.vc/ | Early-stage Tech |

| Jungle Ventures | https://www.jungle.vc/ | Southeast Asia and India |

Columns included in our list

Through our list, you can get an overview of the largest Singaporean venture capital investors. In detail, the list offers the following data points:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

Portrait of Vertex Ventures SEAI: Leading VC for Southeast Asia and India

Vertex Ventures SEAI is one of the foremost venture capital firms focusing on early-stage investments across Southeast Asia and India. With a strong global network and deep industry expertise, Vertex Ventures serves as a trusted partner to innovative entrepreneurs, offering not just funding but also strategic guidance, access to talent, and key industry connections. The firm’s investment philosophy revolves around fostering digital transformation and empowering entrepreneurs tackling some of the world’s most pressing challenges.

As a sector-agnostic investor, Vertex Ventures primarily focuses on the vast growth potential of the digital economy in emerging markets. Its portfolio companies often contribute to economic empowerment, MSME enablement, inclusivity, and climate action across the region. A recent highlight of Vertex Ventures’ investment strategy is its $16 million Series A funding round for Spyne, India’s first AI-powered visual merchandising platform for the automotive industry. This investment will fuel Spyne’s expansion into the U.S. and high-growth regions across EMEA and APAC, leveraging cutting-edge AI to redefine vehicle showcasing and automotive retail.

Picture source: Getty Images (Feb 18th, 2025)

![List of the 30 largest Venture Capital Funds from Singapore [2025]](https://www.thousandinvestors.com/wp-content/uploads/2025/02/Singapore-Venture-Capital-Investors.png)

![List of the 250 largest Proptech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Proptech-Investors-List.png)

![List of the 250 largest Web3 Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Web3-Investors-List.png)

![List of the 1,000 largest SaaS Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/SaaS-Investors-List.png)

![List of the 800 largest Travel Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Travel-Investors-List.png)

Reviews

There are no reviews yet.