We wrote this article while researching for our list of the 700 largest life science startup focused venture capital funds. The list can be downloaded with a few clicks and includes the most relevant investors for life science startups. We identified the included funds based on our sophisticated crawler technology and manual research.

Introduction to DHVC

Danhua Capital, also known as DHVC, is a venture capital firm based in the United States. With a strong presence in the industry, they have made significant strides in supporting startups and businesses with potential for high growth.

Investment Focus of DHVC

While the information provided does not explicitly state whether DHVC invests in life science startups, it’s crucial to understand their investment focus. Venture capital firms like DHVC typically invest in industries that show promise for exponential growth and high returns on investment.

Past Investments and Portfolio Companies

Unfortunately, the information provided does not include specific details about past investments or portfolio companies of DHVC. However, these details can often provide insight into a venture capital firm’s preferences and areas of interest.

Geographical Focus of DHVC

DHVC is based in the United States, which could suggest a geographical focus on domestic ventures. However, many venture capital firms also consider international opportunities that align with their investment strategy.

Office Locations of DHVC

The specific office locations of DHVC are not included in the provided information. Knowing where a venture capital firm has offices can sometimes give insight into their geographical focus and reach.

Submitting Your Venture to DHVC

If you’re interested in seeking investment from DHVC for your startup or business, they offer an online submission process. This includes uploading a non-confidential investor deck to provide them with more information about your venture.

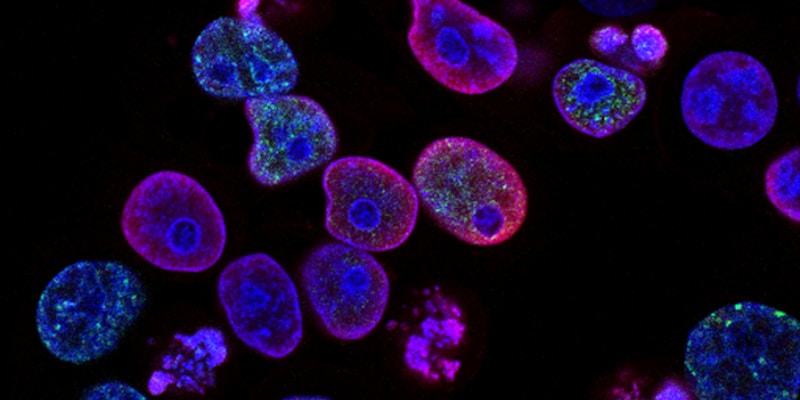

In conclusion, while we cannot confirm if DHVC specifically invests in life science startups based on this information alone, understanding their overall approach to venture capital can provide some insight. It’s always recommended to research further or reach out directly to the firm for more specific information. Picture source: National Cancer Institute