This article is based on the research process for our list of the 700 largest investors for biotechnology startups. You can download the list with just a few clicks.

About Roche Venture Fund

Roche Venture Fund is the corporate venture capital arm of Roche, a global leader in providing innovative medicines and in vitro diagnostics for patients. The fund is dedicated to making investments in life science companies, with a focus on creating value through fostering innovation, guiding successful businesses, and generating financial returns for Roche.

Investment Focus

The Roche Venture Fund primarily invests in life science companies operating in the fields of pharmaceuticals, diagnostics, and digital health. This aligns with Roche’s broader strategy of harnessing the power of data to shape future innovations and delivering long-lasting medical benefits for patients.

Geographical Presence

The team managing the Roche Venture Fund operates out of two main locations: Basel, Switzerland and South San Francisco, USA. This geographical spread allows them to tap into diverse markets and opportunities across different regions.

Fund Size & Structure

The fund is structured as an evergreen fund with CHF 750M under management. An evergreen fund structure means that there are no fixed time limits on investments, allowing for a long-term vision and commitment towards portfolio companies.

Active Involvement in Portfolio Companies

Beyond providing financial support, Roche Venture Fund also actively involves itself within its portfolio companies. They offer their expertise to drive shared success together with their portfolio companies. This approach ensures that the startups they invest in receive more than just funding – they gain access to valuable industry knowledge and guidance.

Investment in Biotechnology Startups?

In line with its investment focus areas, it can be inferred that Roche Venture Fund does invest in biotechnology startups. These investments are aimed at developing commercially successful innovative life science companies, which aligns with Roche’s overall vision of being an integrated healthcare company that drives more effective and efficient research and enables better therapeutic decisions for patients.

Conclusion

In conclusion, the Roche Venture Fund is a significant player in the life science investment space, focusing on pharmaceuticals, diagnostics, and digital health. They offer not just financial support but also their expertise to guide startups towards success. Their active involvement in portfolio companies and long-term vision make them a valuable partner for biotechnology startups looking to make a significant impact in healthcare.

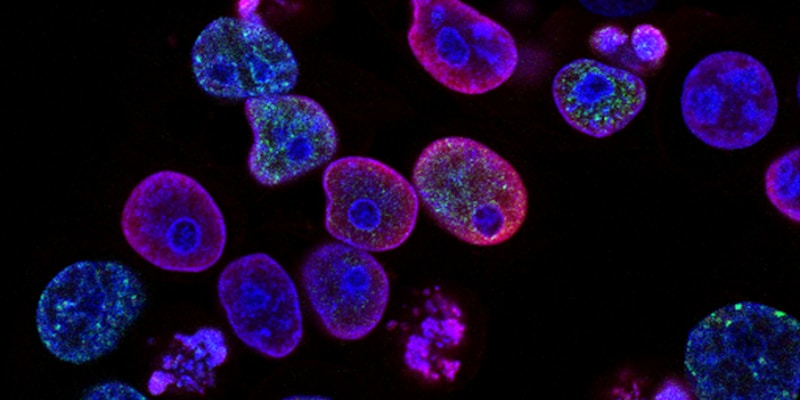

Picture source: National Cancer Institute