This article directly stems from the research process for our global venture capital investors database. Based on this list and our advanced keyword crawler technology, we created a list of venture capital investors that mention battery-related keywords on their website. The list – offered as an Excel file – is perfectly suited to get in touch with the most relevant investors in the field.

![]()

This article offers an insight into three interesting startup investors in the United States from our keyword crawler based global battery venture capital funds list.

1. Braemar Energy Ventures (New York)

Braemar Energy Ventures is a venture capital firm focused on early–stage investments in clean energy and energy efficiency technologies. Founded in 2006, Braemar has invested in over 50 companies across the US, Europe and Asia. The firm’s mission is to bring the world’s best clean energy and energy efficiency technologies to market. One of their portfolio companies is ChargePoint who are the leading electric vehicle charging network in the world.

2. Trucks VC (San Francisco)

Trucks VC is a venture capital firm focused on early stage investments in the logistics and trucking industry. They primarily focus on companies that are looking to revolutionize the transportation and logistics industry through automation, digitization, and other disruptive technologies. Additionally, they are interested in companies that offer new ways to measure and optimize performance. Cling Systems is one of the startups they have supported. The startup enables a full lifecycle for lithium-ion batteries.

3. Loup Ventures (Minneapolis)

Loup Ventures was founded by Gene Munster and Doug Clinton. The company invests in early-stage startups in technology. The firm has invested in a variety of companies in the consumer, enterprise, and healthcare industries. Loup Ventures takes a data–driven approach to investing and is committed to the long–term success of the companies it invests in. The company offers not only capital to their portfolio companies but also access to mentors, advisors, and an expansive network.

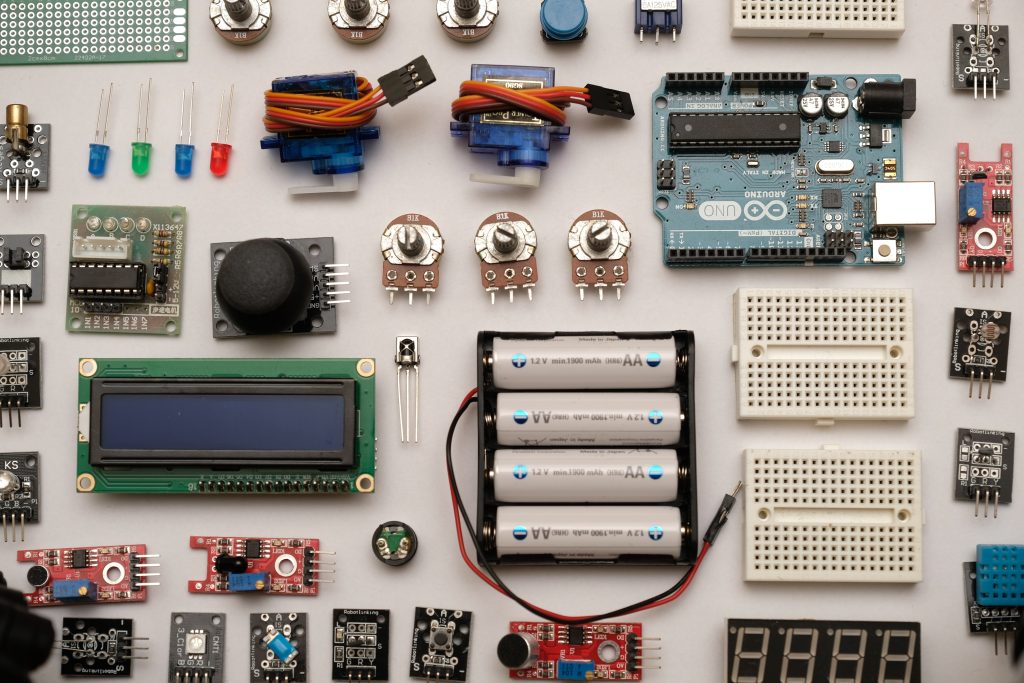

Picture Source: Roberto Sorin

![List of the 200 largest Battery Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Battery-Technology-Investors-List.png)