Description

![List of the 90 largest Buy-and-Build Private Equity Investors Europe [2023] List of the 90 largest Buy-and-Build Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/austin-distel-gUIJ0YszPig-unsplash-scaled.jpg)

List of 3 large European buy-and-build-focused private equity funds

Buy-and-build transactions in private equity involve a private equity firm acquiring a platform company and pursuing additional acquisitions to enhance the platform company’s market position. This strategy is particularly effective in fragmented industries, where consolidating several smaller companies under a single umbrella can lead to improved market share, economies of scale, and operational efficiencies.

1. Penta Capital LLP (London, United Kingdom)

Penta Capital LLP is an independent private equity fund management business based in London. Established in 1999, the firm primarily focuses on the mid-market, investing between £5 million and £200 million. PC seeks out businesses with strong management teams and a proven track record of profitable growth. They typically focus on deals ranging from £5 million to £200 million. The investment company is known for its sector expertise and decisive approach to deal-making, financing, and the buy-and-build process. They have been instrumental in creating value in their portfolio companies, which have a combined enterprise value exceeding £3 billion.

Update 2024: In 2023, the British private equity firm Connection Capital co-invested in Thistle Initiatives Group. The £5,6 million co-investment was led by Copper Street Capital and aims to support the long-term growth of Thistle Initiatives.

2. Perusa GmbH (Munich, Germany)

Perusa GmbH is a private equity firm based in Munich, Germany. They specialize in acquiring and developing mid-sized companies in transformation situations, with a primary focus on German-speaking countries and the Nordics. Perusa invests in mid-sized companies and corporate carve-outs. They invest in companies changing such as secondaries, carve-outs, or facing succession issues or performance improvement potential. Perusa’s adaptability and strategic investment approach allow them to invest in companies in a state of change.

3. Connection Capital LLP (London, United Kingdom)

Connection Capital LLP is a London-based private equity firm. It provides access to private equity transactions and alternative investment funds that are typically only available to institutional capital. The firm was founded in 2010 and offers investment opportunities in profitable, private UK businesses with significant growth potential. Connection Capital has been involved in numerous buy-and-build transactions. The M&A summary demonstrates a track record of purchasing and divesting companies in diverse sectors, with substantial deal values. Notable transactions include buyouts, growth capital investments, and secondary buyouts in industries such as business services, restaurants, real estate, and technology hardware.

Picture source: Unsplash

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds help to get in touch with the executives and investment managers of the included firms.

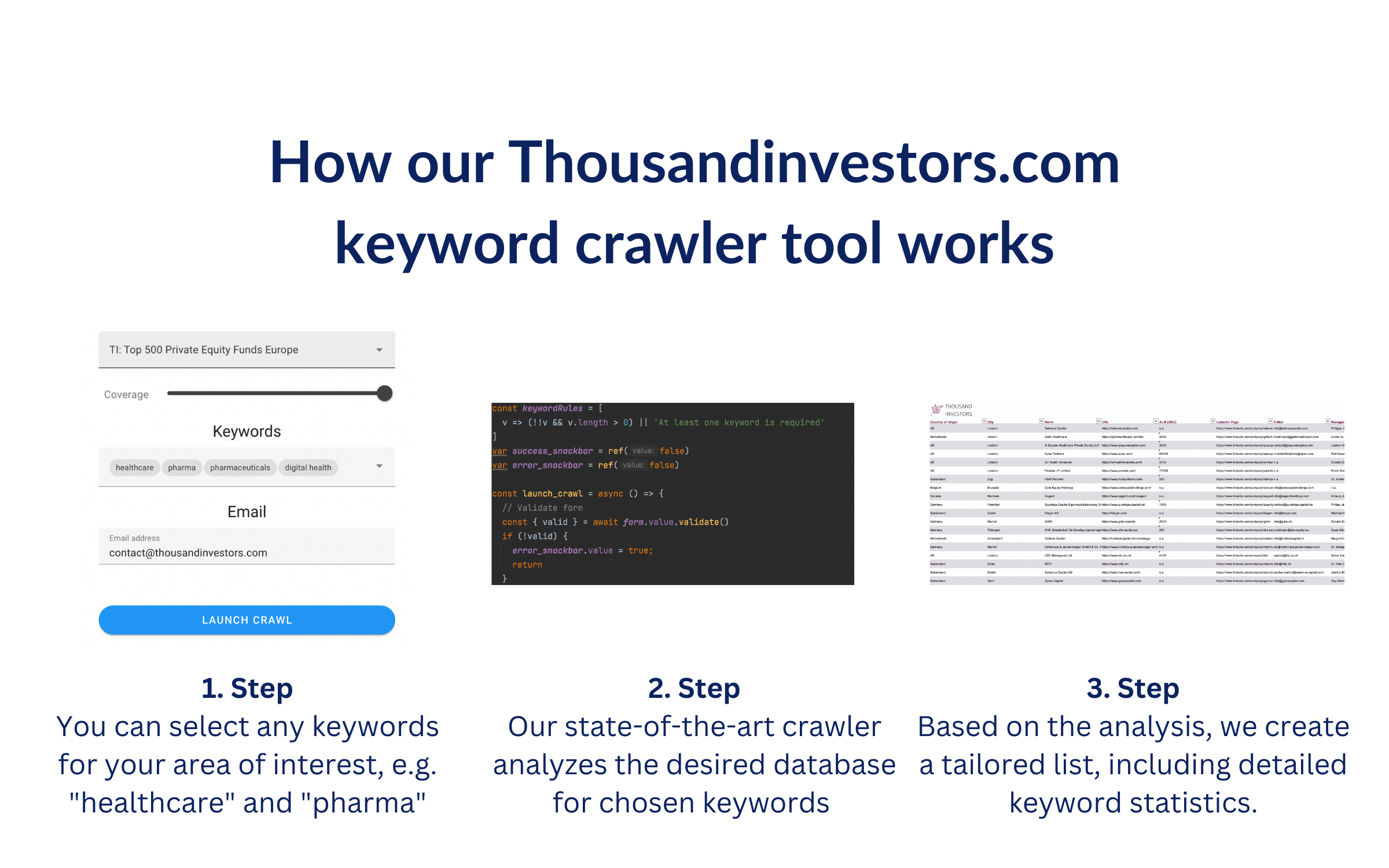

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keywords “buy and build, leveraged build-up, strategic roll-up“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords were found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 90 largest Buy-and-Build Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Buy-and-Build-Private-Equity-Investors.png)

![List of the 70 largest Buy-and-Build Private Equity Investors Europe [Update 2025] - Image 2](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Buy-and-Build-Private-Equity-Europe.png)

![List of the 300 largest Healthcare Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Healthcare-Private-Equity-Investors-1.png)

![List of the 140 largest Succession Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Succession-Private-Equity-Investors.png)

![List of the 30 largest Private Equity Funds in Sweden [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Sweden.png)

![List of the 190 largest Private Equity Funds UK [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-UK.png)

Reviews

There are no reviews yet.