Description

![List of the 300 largest Buy-Out Private Equity Investors Europe [2023] List of the 300 largest Buy-Out Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/charles-forerunner-3fPXt37X6UQ-unsplash-1-scaled.jpg)

List of 3 large European buy-out-focused private equity funds

Buyout strategies in private equity entail acquiring a controlling stake in a company, usually via two primary transactions: Leveraged Buyouts (LBOs) and Management Buyouts (MBOs). Buyout funds, which enable such transactions, can be sorted by size (large, mid-sized, or small) and frequently center on gaining majority or controlling ownership in a company. The aim is to generate value through various avenues, such as enhancing operations, expanding multiple aspects, or leveraging. These funds could gravitate towards particular sectors or regions, or opt to spread out across these dimensions.

1. MBO+ (Paris, France)

MBO+ (previously referred to as MBO Partenaires and MBO & Co) is a private equity company located in Paris, France, that specializes in primary transactions within the French Small-Cap sector, with a focus on firms worth between €20 million and €100 million. The organization places a great deal of emphasis on transformational initiatives that rely on skilled management teams and robust, ambitious investment arguments. MBO+ boasts a history of fruitful investments and acquisitions, including securing exclusivity with the Atalian Servest group for the carve-out of their landscape management and maintenance services. This investment strategy strives to take advantage of market opportunities, regular activity recurrence, and considerable fragmentation to stimulate growth and procure success.

Update 2024: In September 2023, the Paris-based private equity company announced Olivier Delrieu as a Partner of MBO+. Delrieu is the CEO of Groupe Trescal and an experienced director of several LBO companies.

2. BPE 4 Unternehmensbeteiligungen GmbH (Frankfurt, Germany)

BPE 4 Unternehmensbeteiligungen GmbH is a private equity firm headquartered in Hamburg, Germany, dedicated to financing Management Buy-outs and, more and more, Management Buy-ins as resolutions to succession difficulties or corporate spin-offs, primarily in the UK SME market. In December 2019, BPE 4 completed its initial round of funding for BPE 4, its fourth investment vehicle, resulting in €122 million being raised. This confirms the company’s active involvement in managing and raising sizable investment funds. The sum obtained demonstrates the corporation’s potential and the confidence investors have in its management and investment approaches.

3. Primary Capital Partners LLP (London, UK)

Primary Capital Partners LLP, headquartered in London, is a private equity firm that collaborates with management teams to cultivate exceptional businesses. It concentrates on UK-based growth companies valued at £20 million to £100 million. PCP prioritizes management, growth, and resilience, and allocates investments mainly in the Service, Technology, Industrial Technology, and Consumer & Leisure sectors.

Moreover, Management Buy-Outs serve as an essential strategy for the investment firm located in London. In 2017, PCP completed a management buyout (MBO) of Readypower Engineering Limited, which is a leading provider of accredited plant hire services to the regulated rail sector in England and Wales.

Picture source: Unsplash

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds help to get in touch with the executives and investment managers of the included firms.

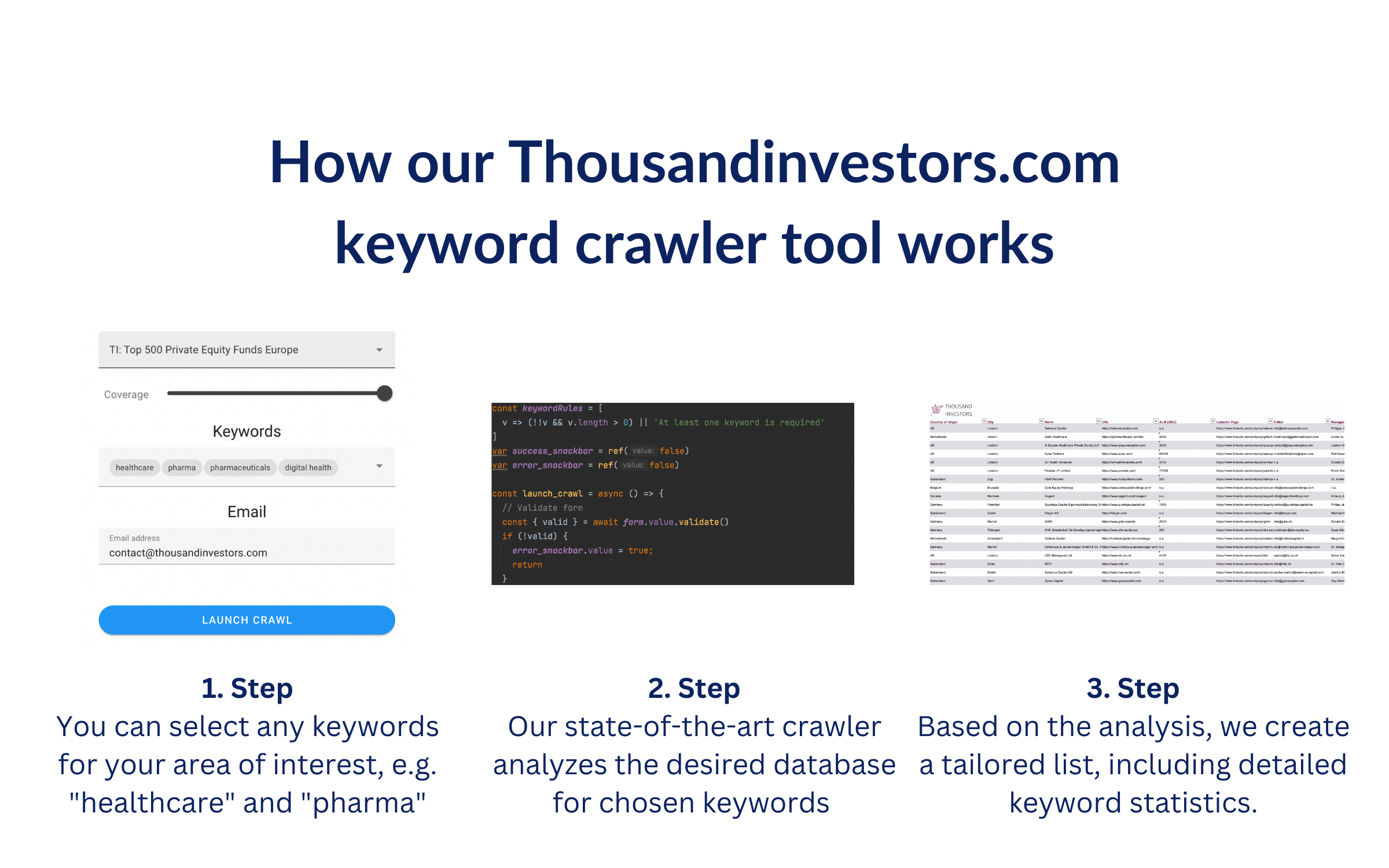

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keywords “Buyout, MBO, EBO, LBO“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords were found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 300 largest Buy-Out Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Buy-Out-Private-Equity-Investors.png)

![List of the 300 largest Buy-Out Private Equity Investors Europe [Update 2025] - Image 2](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Buy-Out-Private-Equity-Europe.png)

![List of the 90 largest Private Equity Funds in France [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-France.png)

![List of the 250 largest Food Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Food-and-Beverage-Private-Equity-Investors.png)

![List of the 300 largest Infrastructure Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Infrastructure-Private-Equity-Investors.png)

![List of the 30 largest Private Equity Funds in Sweden [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Sweden.png)

Reviews

There are no reviews yet.