Description

![List of the 50 largest Climate Tech Private Equity Investors Europe [2023] List of the 50 largest Climate Tech Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/manny-becerra-NgdhrwAx0J8-unsplash-1-scaled.jpg)

List of 3 large European climate-tech-focused private equity funds

Investment in the climate tech sector has seen dynamic shifts and trends. Despite challenging economic conditions in 2023, climate tech has continued to attract significant attention in the private equity space. Significant investments have been made in technologies with higher emission reduction potential. There’s a growing alignment between funding and the emissions reduction potential of technologies, indicating a strategic shift in investment focus. In particular, more funds are being allocated to start-ups targeting emissions from industrial sectors and those working on high-ERP technologies such as carbon capture, utilization and storage, green hydrogen, and alternative food.

1. Altor (Sweden, Stockholm)

Altor, a private equity firm based in Stockholm, Sweden, has been investing in the climate tech sector with a strong commitment to green transition investments. Altor acquired a significant minority stake in Svea Solar, a leading solar solution provider in Sweden and the third largest in Europe. Svea Solar aims to become the market leader in the solar residential space and cover 80% of Europe by 2026. The company offers sustainable energy solutions, including solar panel systems, batteries, and electric car chargers, and has operations in multiple European countries.

Update 2024: In the Aira Series B equity financing round, Altor Funds acquired a minority stake in October 2023. Aira’s business model is vertically integrated, and it offers a direct-to-consumer service for manufacturing, selling, and installing heat pumps at scale.

2. Albion Capital Group LLP (London, UK)

Albion Capital Group LLP is an independent investment manager based in London, UK. Established in 1996, they manage investments in sectors such as healthcare, technology, education, and alternative energy. Albion Capital demonstrates a strong commitment to sustainable investing and integrates Environmental, Social, and Governance (ESG) principles throughout their business, including their firm operations, managed funds, and supported founders. Their involvement in the climate tech sector is evident. One of their investments in the climate tech sector is Gaussion, a company working on revolutionizing batteries through magneto-electrochemistry technology, which is in the early stages of development.

3. HPE Growth (Amsterdam, Netherlands)

HPE Growth, located in Amsterdam, Netherlands, is renowned for its focus on growth capital investments in technology companies. The company’s portfolio includes investments in the climate tech sector, reflecting the growing trend of investment firms prioritizing sustainable and environmentally friendly technologies. Climate tech refers to technologies that directly or indirectly reduce greenhouse gas emissions, contributing to the fight against climate change.

Picture source: Unsplash

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds help to get in touch with the executives and investment managers of the included firms.

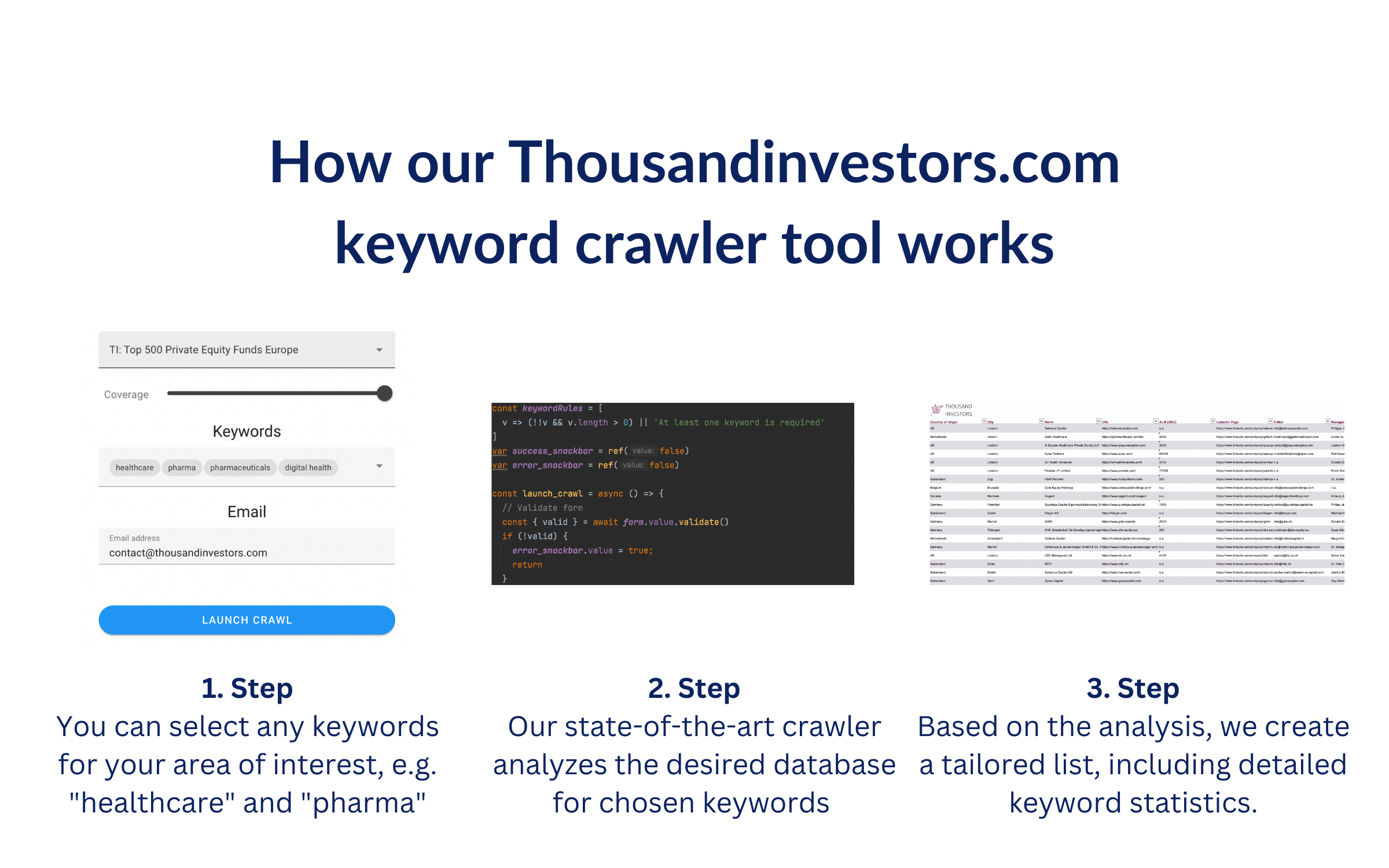

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “climate tech, climate investment, decarbonization, climate change services“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords were found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 50 largest Climate Tech Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Climate-Tech-Private-Equity-Investors.png)

![List of the 50 largest Climate Tech Private Equity Investors Europe [Update 2025] - Image 2](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Climate-Tech-Private-Equity-Europe.png)

![List of the 40 largest Private Equity Funds in the Netherlands [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Netherlands.png)

![List of the 250 largest Food Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Food-and-Beverage-Private-Equity-Investors.png)

![List of the 90 largest Carve-Out Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Carve-Out-Private-Equity-Investors.png)

![List of the 300 largest Consumer Goods Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Consumer-Goods-Private-Equity-Investors.png)

Reviews

There are no reviews yet.