Description

List of 3 large European consumer goods-focused private equity funds

One main investment vertical of European private equity are consumer goods, from clothing to household electronics to cosmetics. In the following, we are introducing you to three interesting private equity investors focused on the Fast Moving Consumer Goods (FMCG) sector.

1. Telemos Capital (London, UK)

UK-based private equity investor Telemos Capital is targeting €50-200M investments in business services, consumer goods and services, and healthcare services companies. Exemplary consumer goods investments are well-being company Lovehoney, outdoor sports and clothing manufacturer Mammut and bicycle tire producer Vittoria.

Update 2024: At the end of 2023, the British private equity firm Telemos Capital acquired a majority stake in Vittoria. Vittoria is renowned for producing high-performance bicycle tyres and related accessories.

2. Permira (London, UK)

Permira is one of the leading private equity firms in Europe, with more than 300 backed businesses and €77bn commited capital. One focus sector of the European private equity firm is called “Consumer”, with €12.5bn invested so far. Permira mainly focuses on digital platforms and distinctive brands. Portfolio companies include shoe producer Dr. Martens, German clothing company Hugo Boss or Italian luxury fashion brand Golden Goose.

3. GIMV (Munich, Germany)

Munich-based private equity firm GIMV targets €5-75M investmend in SME companies from Benelux, France or the DACH area. Consumer goods is one major investment area of GIMV, including food & beverage, pet food & care as well as home & family companies. Portfolio companies include French pet care producer AgroBiothers or baby clothing retailer babyshop.com.

Picture source: PMV Chamara

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds helps to get in touch with the executives and investment managers of the included firms.

Picture source: Emile Perron

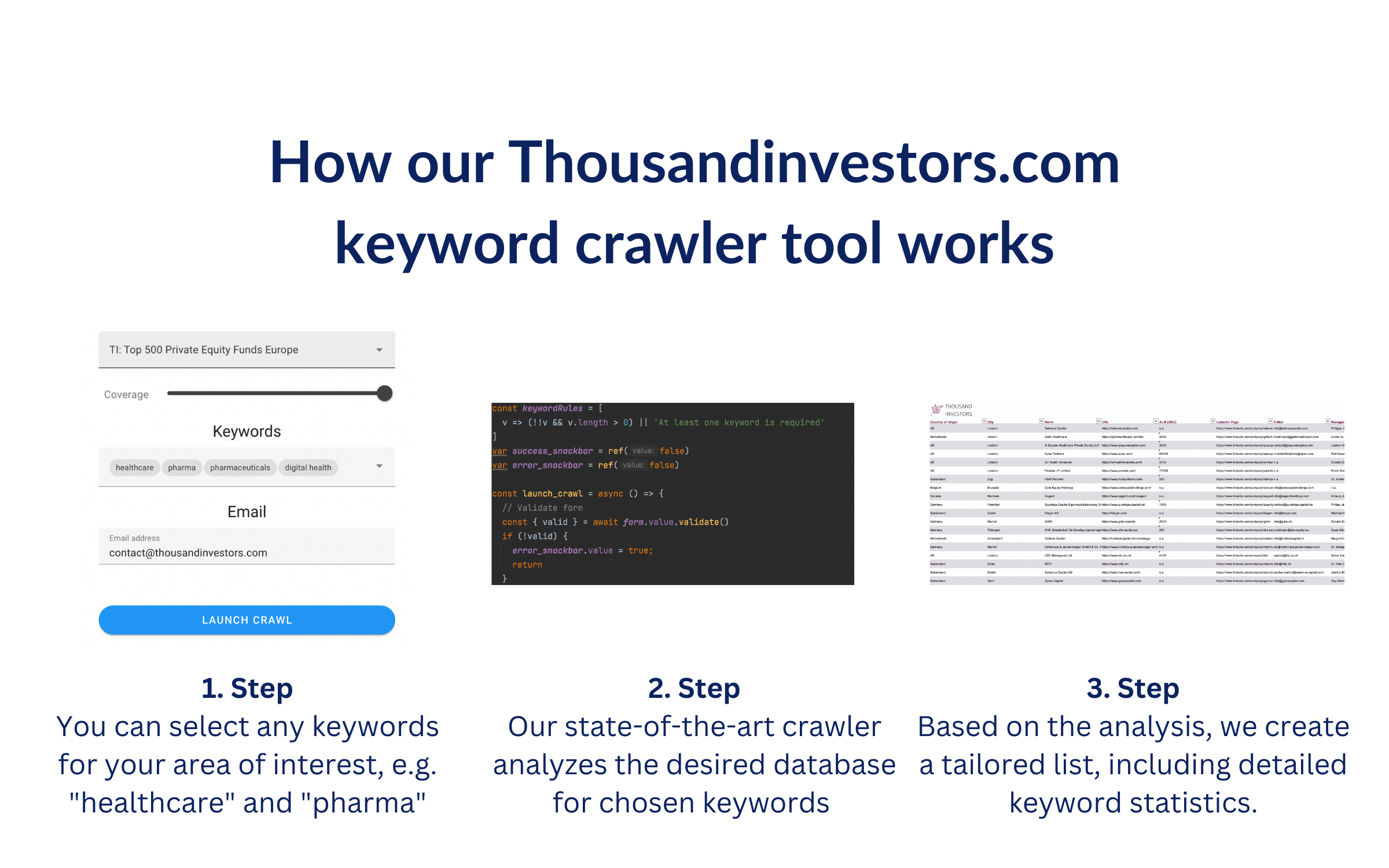

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “consumer”, “consumer goods”, “consumer durables”, “FMCG”. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords where found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 300 largest Consumer Goods Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Consumer-Goods-Private-Equity-Investors.png)

![List of the 90 largest Carve-Out Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Carve-Out-Private-Equity-Investors.png)

![List of the 40 largest Private Equity Funds in the Netherlands [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Netherlands.png)

![List of the 140 largest Succession Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Succession-Private-Equity-Investors.png)

![List of the 40 largest Hydrogen Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/11/Hydrogen-Private-Equity-Investors.png)

Jolanda K. (verified owner) –

Every M&A advisor should have this list, great work!