Description

List of 5 large fashion venture capital investors

The global fashion industry is a dynamic and influential sector that contributes significantly to the global economy and culture. In 2023, the industry is estimated to be worth around $1.71 trillion, reflecting its robust growth and resilience to economic fluctuations. This article highlights five venture capital investors who are particularly active in the fashion sector.

1. REFASHIOND Ventures (New York, USA)

REFASHIOND Ventures, based in New York, is a venture capital firm focused on early-stage investments that aim to transform global supply chains, with a strong focus on the fashion industry. The firm has backed 70 companies, demonstrating its commitment to fostering innovation in the sector. Notable investments include Gildform, a platform that simplifies and streamlines jewellery manufacturing processes, and Partsimony, a company that improves collaboration and efficiency in hardware manufacturing. These investments underline REFASHIOND’s mission to revolutionise fashion supply chains through innovative and sustainable solutions.

Update 2024: In August 2024, REFASHIOND Ventures hosted #SCITMIAMI / The Industrial Transformation of FASHION at the Miami Fashion Institute at Miami Dade College. The event brought together industry leaders and emerging technologies to explore transformative solutions for the fashion supply chain, focusing on innovation, sustainability and efficiency in the sector.

2. HV Capital (Munich, Germany)

Headquartered in Germany, HV Capital is a venture capital firm renowned for its strategic investments in European start-ups, including those in the fashion sector. The firm has made eight notable investments in fashion companies, demonstrating its commitment to driving innovation in the industry. Its portfolio includes Vinted, a leading online secondhand fashion marketplace that promotes sustainable shopping by connecting users to buy, sell and swap clothes. Another key investment is Outfittery, a curated menswear shopping service that offers a personalised shopping experience tailored to individual styles and preferences.

3. LocalGlobe (London, United Kingdom)

LocalGlobe, a leading UK-based venture capital firm, specialises in seed-stage investments across a range of sectors, including fashion. With a portfolio of over 280 companies and 17 unicorns, LocalGlobe has a reputation for backing innovative start-ups that disrupt traditional markets. Notable fashion investments include ZigZag Global, an e-commerce returns optimisation platform that improves retailer efficiency and sustainability, and Depop, a social shopping app that is revolutionising secondhand fashion for younger, sustainability-minded consumers.

4. Titan Capital (Gurgaon, India)

Titan Capital is an early-stage venture capital firm based in India. Established in 2011 by Kunal Bahl and Rohit Bansal, the firm focuses on investing in sectors such as consumer internet, direct-to-consumer brands, SaaS, and fintech. Titan Capital boasts a portfolio of over 300 companies, including Razorpay, Ola, Mamaearth, and Urban Company. The venture capital firm has made significant investments in the fashion sector too. For instance, Showroom B2B, a supply chain platform in the fashion and apparel industry, secured $6.5 million in a pre-Series A funding round on October 19, 2023, with participation from Titan Capital. Fashinza, an AI-driven B2B marketplace for global fashion supply chains, raised a further $30 million in funding on March 28, 2023, with Titan Capital also participating as an investor.

5. Venrex Investment Management (London, United Kingdom)

Venrex Investment Management, founded in 2002 and based in London, is a venture capital firm specialising in early-stage investments in consumer-facing technology and lifestyle businesses. Its portfolio includes over 100 companies, including fashion brands Charlotte Tilbury, a renowned cosmetics label, and ME+EM, known for luxury womenswear. Venrex has also backed platforms such as Notonthehighstreet.com, which showcases a wide range of products from independent designers.

Picture Source: piotr szulawski

Included information in our list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 1536) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.02) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „fashion“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 152) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. http://rightsidecapital.com/portfolio/#active2021) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.08) – highest keyword rate per subpage

- frequency_per_keyword: {‘fashion’: 116, ‘clothing’: 18, ‘clothes’: 1} – dictionary of number of keyword occurrences per keyword

Picture Source: Toa Heftiba

Results of our keyword analysis

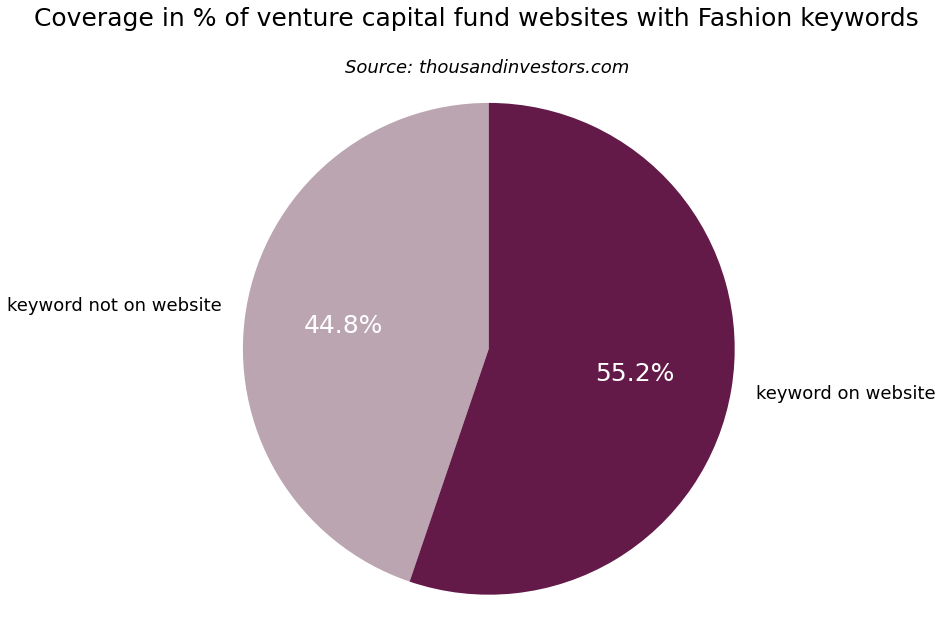

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

Percentage of VC funds that invest in start-ups in the fashion sector

Our keyword crawler analyzed more than 2,500 venture capital funds regarding fashion investment keywords. We found out that 55.2 % of the global VC funds mention fashion.

Focus on fashion and clothing

This bar chart shows the most important keywords from our keyword search, however most companies use the keyword fashion to describe their vc company focus. Additionally, the terms clothing and clothes are used.

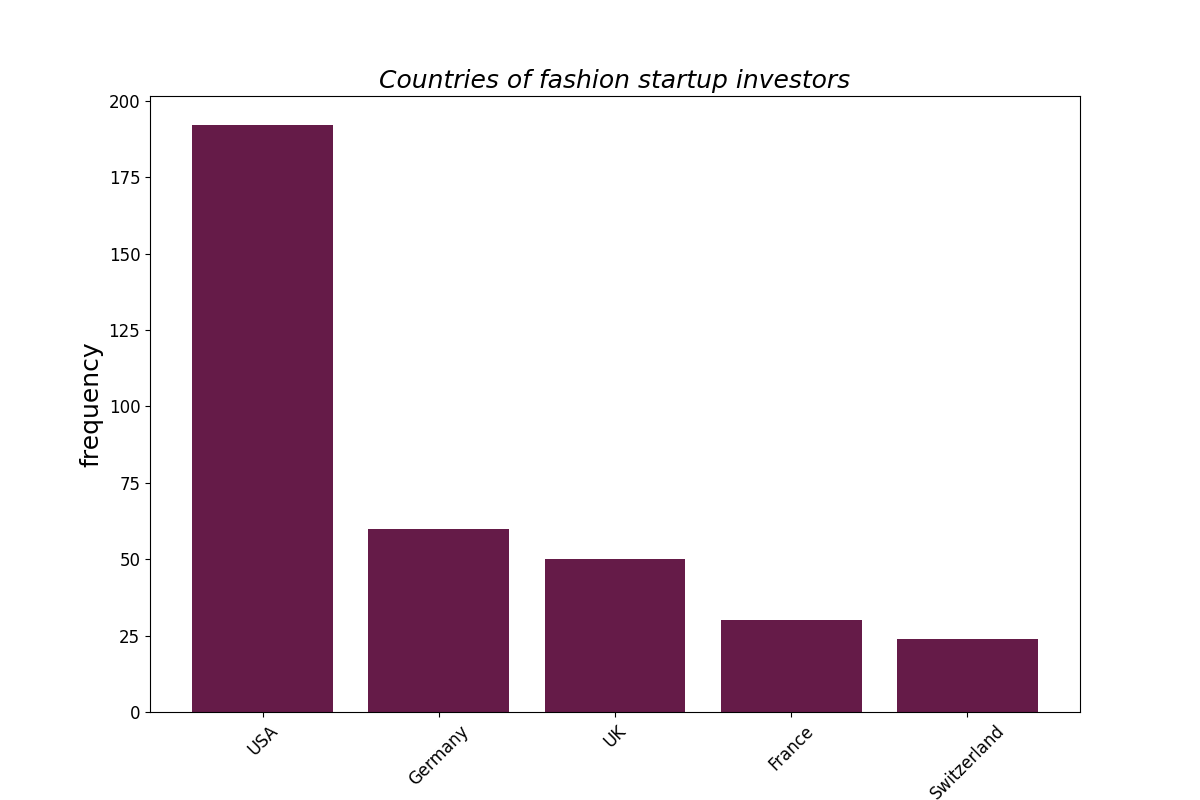

Countries of fashion startup investors

The most common country for fashion startup investors are the USA. For instance, the previously presented investor Lerer Hippeau is located in NYC, New York. Countries with also lots of these investors are Germany, the UK, France, and Switzerland. These countries are known for their strong fashion industries and have a long history of producing high-quality clothing and accessories. In addition, many of these countries are home to world-renowned fashion designers and brands, which makes them attractive locations for fashion startups looking to make a name for themselves. As a result, these countries are home to many successful fashion startups and are popular destinations for investors looking to invest in the fashion sector.

![List of the 600 largest Fashion Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Fashion-Investors-List-1.png)

![List of the 2,000 largest Tech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Tech-Investors-List.png)

![List of the 1,000 largest eCommerce Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Ecommerce-Investors-List.png)

![List of the 300 largest Cleantech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/CleanTech-Investors-List.png)

![List of the 900 largest Mobility Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Mobility-Investors-List.png)

Edmund (verified owner) –

Top list, like the others we acquired. Convincing that almost all investors are really good fit for fashion startups.