Description

List of 5 large Fintech venture capital investors

The financial sector is one of the most influential and important parts of our economy and, with the growth of digitalization, the number of financial technology companies (better known as Fintech) has increased significantly. This article highlights five interesting fintech venture capital investors from our curated list.

1. Alven (France)

Alven is an early-stage venture capital firm based in Paris. As of 2020 Alven has over €2 billion in funds under management and backed more than 160 startups over the last 22 years. Alevn’s sector of interests includes mainly data management platforms, AI, security solutions, Saas, and more. An interesting portfolio company is Qonto, a company that aims to become the next-generation bank for entrepreneurs, SMEs, and startups by providing fast and time-saving online services improving financial visibility, and saving banking fees.

2. Anthemis Group (United Kingdom)

Anthemis Group is a global platform based in London, that aims to solve the financial systems’ most pressing challenges faster and better. The firm invests across all stages of growth from pre-seed to IPO. In 2019 Anthemis launched a Female Innovators Lab Fund, that became the largest early-stage fintech fund dedicated to companies founded by women in 2023. An example portfolio company is Addition Wealth, a financial wellness platform based in New York. The company allows employees to make smart, informed financial decisions, by taking a tech-forward approach.

Update 2024: In April 2023, Anthemis’ Female Innovators Lab Fund reached $50 million, making it the largest early-stage fintech fund dedicated to companies founded by women.

3. Hummingbird Ventures (Belgium)

Hummingbird Ventures is a Belgium-based venture capital firm that specialises in investing in early-stage technology companies. Recently, the firm has expanded its portfolio to include Thaleron, a UK-based company developing cost-effective mechanical energy storage technology to support the decarbonisation of the global power grid. Additionally, Hummingbird Ventures has invested in Etched, a US-based company developing “Sohu”, the world’s first transformer-specific chip.

4. Viola (Israel)

The Viola Group, a prominent Israeli venture capital firm founded in 2000, has a particular emphasis on investments in the fintech sector. Over the past 12 months, Viola has made significant progress in this area, as evidenced by its recent investment in Kriya, a UK-based fintech company specialising in B2B payment solutions. In January 2024, Viola Group provided a £50 million funding facility to Kriya, a significant development that underscores its commitment to fostering the growth of the fintech ecosystem. This investment is strategically aligned with Viola Group’s vision to facilitate Kriya’s ambition to process over £1 billion in B2B payments within the next two years.

5. Redstone Digital GmbH (Germany)

Redstone Digital GmbH is a German venture capital firm that specialises in early-stage investments across sectors such as FinTech, PropTech, and digital solutions for SMEs. In May 2023, Redstone led a €4 million seed funding round for Kertos, a Berlin-based SaaS startup offering automated data protection and compliance workflows, ensuring GDPR compliance without data transfers outside the EU. In addition, Redstone participated in a €6 million seed funding round for Empion, an AI-driven recruitment platform that matches employers and job seekers based on company culture, personality, and skills.

Picture Source: ben o’bro

Included information in our Fintech investor list

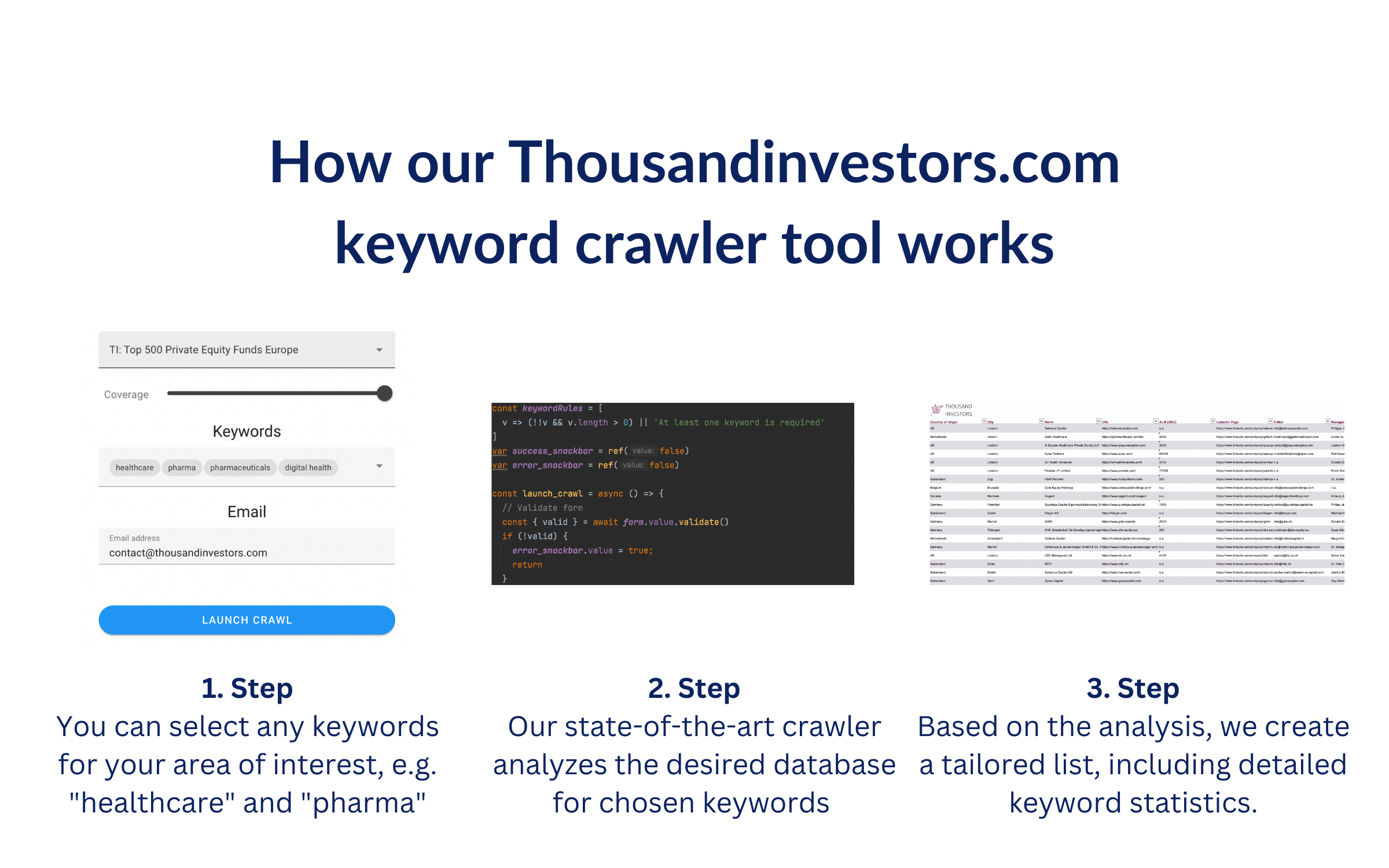

Our keyword analysis-based list include the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 3420) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.02) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „fintech“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 4832) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://mendoza-ventures.com/) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.066) – highest keyword rate per subpage

- frequency_per_keyword: {‘fintech’: 4832, ‘fintechs’: 0, ‘neobank’: 0} – dictionary of number of keyword occurrences per keyword

Picture Source: Stephen Dawson

![List of the 900 largest Fintech Startup Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Fintech-Investors-List-1.png)

![List of the 250 largest Web3 Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Web3-Investors-List.png)

![List of the 600 largest Fashion Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Fashion-Investors-List-1.png)

![List of the 1,000 largest EdTech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Edtech-Investors-List.png)

![List of the 700 largest Crypto Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/10/Thousand-Investors-Crypto-1.png)

Reviews

There are no reviews yet.