Description

List of 5 large HealthTech venture capital investors

Healthtech startups have played an increasingly important role in the healthcare industry for several years. On the one hand, this is due to the possibility of increasing efficiencies and saving costs through digital services. On the other hand, health tech startups also offer entirely new services that are only possible through artificial intelligence and other data-driven methods. Venture capital investors interested in digital health startups partly come from the biotech environment and have a classical software background. The healthcare sector consists of businesses that offer medical services, equipment, and treatment. The health tech sector is striving towards facilitating the provision of healthcare to patients around the world and improving current standards and situations. This article describes five healthcare venture capital investors who aim to support the healthcare and digital health industry by investing in innovative startups.

1. Partech (France)

Partech is a VC company headquartered in Paris that manages around $2.5Bn assets and has invested in over 240 portfolio companies. One of them, for example, is BioBeats. BioBeats leverages artificial intelligence and machine learning to improve mental health and well-being. Their platform utilizes wearable devices and advanced algorithms to monitor physiological parameters, such as heart rate variability and sleep patterns.

Update 2024: In December 2023, Partech launched its successor €360M venture fund to support mission-critical software, data, and fintech specialists in Europe. Additionally, they announced their first investment in Smartpricing.

2. Ambit Health Ventures (USA)

Ambit Health Ventures, a venture capital firm founded in 2021 and headquartered in Newton, Massachusetts, specialises in early-stage investments in the healthcare sector, with a particular focus on digital health and medical technology. In the past year, the firm has made substantial investments in the healthtech sector. Lately, it led a $6.1 million Series A funding round for Smartlens, a clinical-stage ophthalmic technology company. This investment is intended to support the regulatory clearance of miLens, an innovative, electronics-free soft contact lens designed to monitor intraocular pressure in patients with glaucoma and ocular hypertension. During the same month, Ambit Health Ventures also made an investment in Wavely Diagnostics, a company that is developing healthtech application software.These investments are indicative of the firm’s commitment to advancing innovative healthcare solutions that address critical medical challenges.

3. EQT Ventures (Switzerland)

EQT Ventures is a venture capital firm aiming to invest €1 to €75M in start-ups and scale-ups across Europe and the United States. The fund EQT Ventures III started in November 2022, with commitments of €1.1Bn. An exciting portfolio company is Ada Health, an AI-powered health companion that provides users personalized medical insights and guidance. Another portfolio company in the health tech sector is Huma, a digital health company that leverages real-world data and advanced analytics to help patients and healthcare providers. Huma’s platform enables remote patient monitoring, personalized care management, and early intervention through continuous data collection and analysis.

4. MedTech Innovation Partners (Switzerland)

MedTech Innovation Partners (MTIP) is a growth and buyout firm that was established in 2014 and is based in Basel, Switzerland. The company specialises in healthcare software companies, with a focus on accelerating European businesses that are transforming global healthcare. The aim is to drive growth and improve lives through impactful innovation. In 2024, it acquired a majority stake in Dossier Solutions, a leading healthcare competency management SaaS provider. Dossier Solutions helps hospitals streamline regulatory compliance and enhance patient care by automating the tracking of staff competencies, reducing administrative burdens, and improving care quality and outcomes. In addition, in 2024, MTIP led a €13 million growth financing round for Hexarad, a company that provides teleradiology services and proprietary software to improve efficiency, reduce patient waiting times, and generate cost savings across radiology services. These investments underscore MTIP’s commitment to advancing innovative healthtech solutions that enhance healthcare delivery and patient outcomes.

5. Bionova Capital (Portugal)

Bionova Capital is a VC founded in 2015 with its headquarters in Lisbon. It is a healthcare-focused company that invests in early-stage startups across Europe. Specifically, it funds therapeutics, medtech, and digital health applications. Adapttech is part of its portfolio. This UK-based project developed a new prosthetics fitting solution for lower limbs using a 3D scanner.

Picture Source: National Cancer Institute

Included information in our list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 456) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.014) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „digital health“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 428) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://www.sparrow-ventures.com/portfolio) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.05) – highest keyword rate per subpage

- frequency_per_keyword: {‘digital health’: 216, ‘mobile health’: 1, ‘health apps’: 0, ‘digital healthcare’: 136} – dictionary of number of keyword occurrences per keyword

Picture Source: Mockup Graphics

Results of our keyword analysis

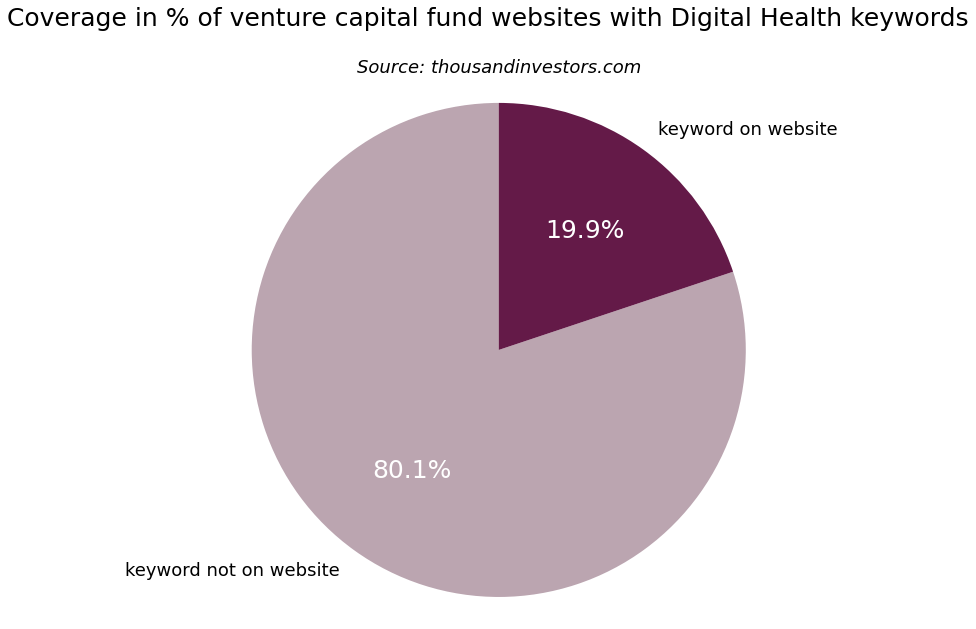

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

Percentage of VC funds that invest in start-ups in the healthcare sector

Our keyword crawler analyzed more than 2,500 venture capital funds regarding healthtech investment keywords. We found out that 19.9 % of the global VC funds mention digital health.

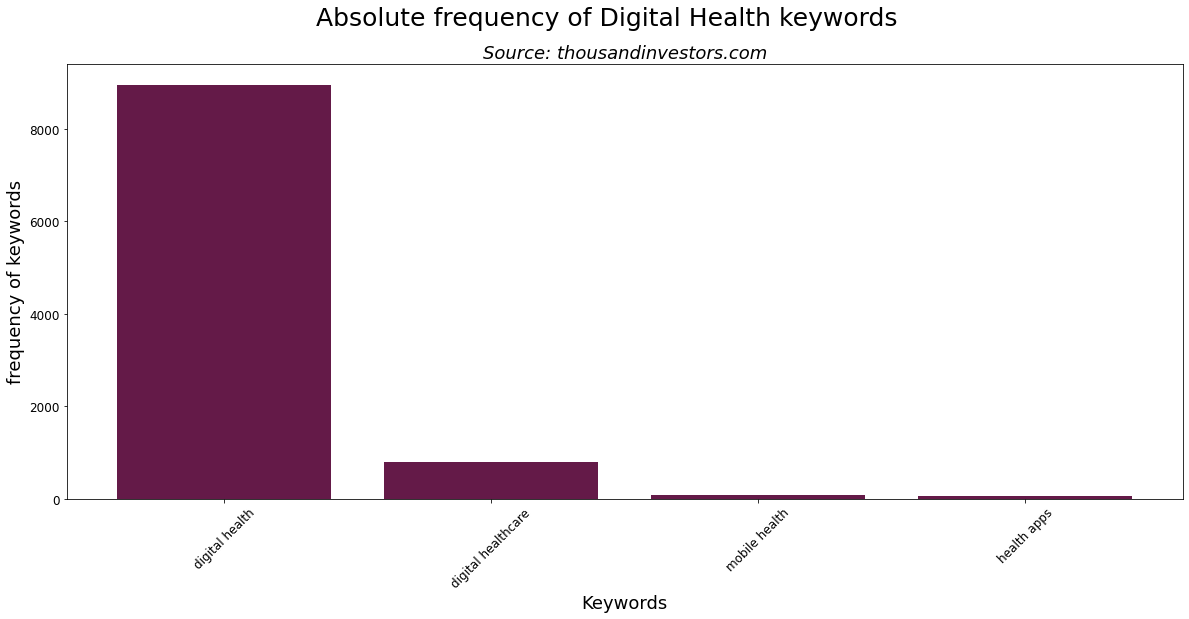

Focus on digital health

This bar chart shows the most important keywords from our keyword search, however most companies use the keyword digital health to describe their vc company focus. Additionally, the term digital healthcare is used, whereas mobile health and health apps are not used as frequently.

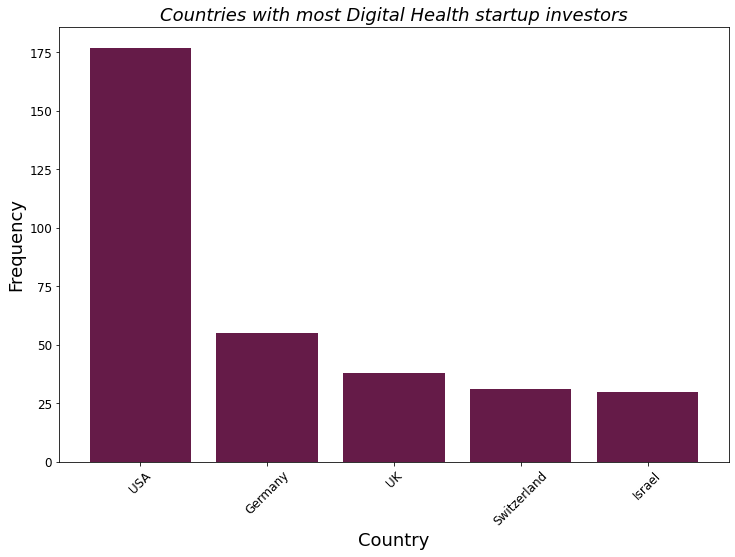

Countries of digital health startup investors

The most common country digital health startup investors are located in is the USA. For instance, the previously presented investor HealthX Ventures is located in Madison, Wiskonsin. Also, a lot of healthtech investors are located in Germany, the UK, Switzerland, and Israel. As a result, these countries are home to many successful digital health startups and are popular destinations for investors looking to invest in the healthtechsector.

![List of the 400 largest HealthTech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Digital-Health-Investors-List.png)

![List of the 2,500 largest Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Global-VC-Investors-List-2.png)

![List of the 300 largest Cleantech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/CleanTech-Investors-List.png)

![List of the 800 largest Travel Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Travel-Investors-List.png)

![List of the 1,000 largest eCommerce Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Ecommerce-Investors-List.png)

F. Warcock (verified owner) –

Very valuable overview, 5 stars