Description

![List of the 40 largest hydrogen private equity investors Europe [2023] List of the 40 largest hydrogen private equity investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/11/engin-akyurt-po6SeO89eCM-unsplash-scaled.jpg)

List of 3 large European hydrogen-focused private equity funds

The hydrogen industry is witnessing substantial advancements in investment and worldwide expansion. Global investments in establishing the hydrogen economy totaled approximately €14.1 billion in 2021, are anticipated to surpass €15.4 billion in 2022, and are forecast to attain €29.2 billion by 2027. Despite a plethora of partnerships between private and governmental groups, investment and capital raising have been indispensable to this growth. Notably, mergers and acquisitions in this sector attained a value of €24.4 billion in 2022, marking a 288% rise from the previous year. Several large European private equity funds are active investors in the hydrogen field. We are introducing you to three firms from our list.

1. Seafort Advisors GmbH (Hamburg, Germany)

Seafort Advisors, a privately held equity firm established in 2012 and headquartered in Hamburg, predominantly invests in medium-sized growth companies in the DACH area. In May 2021, Seafort Advisors made a markable investment in the hydrogen sector by backing APEX Energy, a cutting-edge hydrogen fuel cell company. The APEX Group is a pioneer in the green energy transition. The hydrogen company creates strategies to achieve an industrial-scale CO2-neutral energy supply. Additionally, the company possesses its own H2 production facility and runs an H2 power plant that comes with an attached H2 filling station for the regional supply of hydrogen to businesses.

2. Swen Capital Partners (Paris, France)

Swen Capital Partners, based in the heart of Paris, is a private equity firm overseeing assets worth approximately €5.6 billion. The company has made noteworthy progress in the investment of hydrogen technology, particularly by emphasizing sustainable gases. Swen Capital Partners invests directly in methanation, renewable hydrogen, and gas, specifically for the overland and shipping transportation sectors. This demonstrates their dedication to sustainable energy sources and the required infrastructure. Furthermore, the investment firm has successfully secured €150 million for the initial closing of their second fund, dedicated to renewable gases, known as the Swen Impact Fund for Transition 2 (SWIFT 2). This fund specifically channels investment into mechanization and renewable hydrogen, as well as environmentally friendly infrastructure such as renewable heat networks and energy storage.

3. Longship AS (Oslo, Norway)

Longship operates as a private equity firm that concentrates on making long-term investments in small to medium-sized Norwegian businesses. Longship co-invests with prior owners, management, or staff members, and intends to acquire majority ownership stakes. The company has made significant progress in the hydrogen industry, especially by investing in SEAM, previously named Westcon Power & Automation. SEAM is renowned for providing top-notch hybrid and fully electric propulsion systems and automated solutions for various vessels, including ferries and ships.

Update 2024: In early 2024, Longship AS, a Norwegian private equity company, invested in Star Information Systems AS through its Fund ‘Longship Fund III’, acquiring a majority stake in the global provider of maritime software solutions.

Picture source: Unsplash

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds help to get in touch with the executives and investment managers of the included firms.

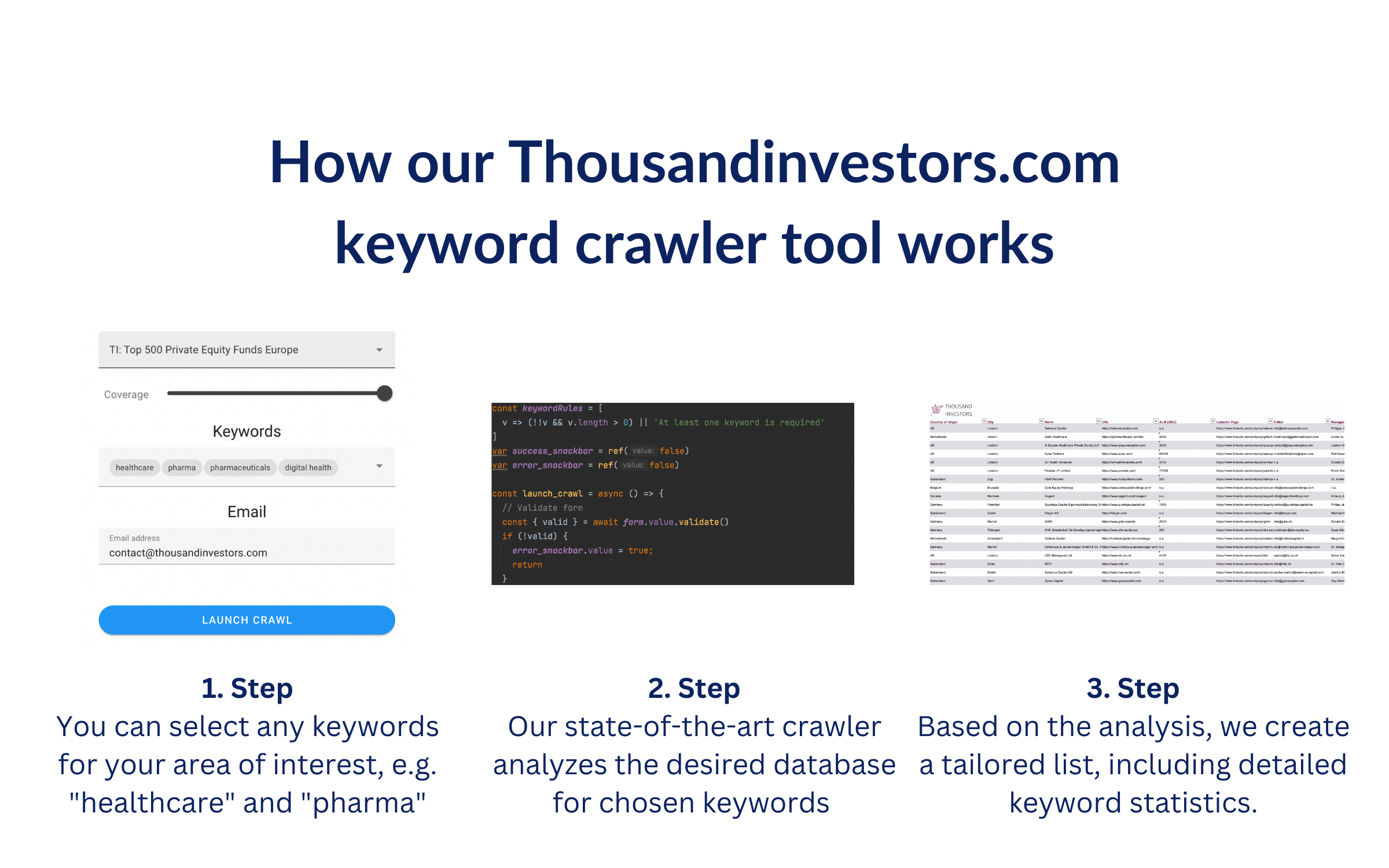

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “hydrogen“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords were found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 40 largest Hydrogen Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/11/Hydrogen-Private-Equity-Investors.png)

![List of the 40 largest Hydrogen Private Equity Investors Europe [Update 2025] - Image 2](https://www.thousandinvestors.com/wp-content/uploads/2023/11/Hydrogen-Private-Equity-Europe-1.png)

![List of the 150 largest Sports Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Sports-Private-Equity-Investors.png)

![List of the 80 largest Spin-Off Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Spin-Off-Private-Equity-Investors.png)

![List of the 90 largest Buy-and-Build Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Buy-and-Build-Private-Equity-Investors.png)

![List of the 250 largest Food Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Food-and-Beverage-Private-Equity-Investors.png)

Reviews

There are no reviews yet.