Description

List of 5 large proptech venture capital investors

Despite being one of the largest asset classes globally, real estate is one of the least digitised sectors in the world. As a result, real estate technology (proptech) has become indispensable in recent years. This article highlights five interesting proptech venture capital investors who are actively investing in building and property start-ups.

1. Fifth Wall (Los Angeles, USA)

Fifth Wall is the largest venture capital firm focused on technology for the global real estate industry, investing in solutions that address key challenges such as climate change, aging infrastructure and housing accessibility. The firm operates at the intersection of real estate and technology, using its consortium model to partner with key industry players to fund innovative solutions for the built environment. With a portfolio that includes companies such as Procore, a leading construction management platform, Opendoor, a pioneer in digital real estate transactions, and Veev, a modular homebuilding technology company, Fifth Wall demonstrates its commitment to future-proofing the real estate sector. The firm is also prioritising investment in climate technology, recognising that real estate is a significant contributor to global emissions, accounting for up to 40% of energy use and emissions.

Update 2024: Fifth Wall has made significant investments in 2024, expanding its portfolio with 11 new companies such as Purpose, a German company focused on sustainable building materials.

2. Camber Creek (New York, USA)

Founded in 2011, Camber Creek is a venture capital firm focused on investing in real estate technology companies. With a portfolio that includes notable names such as Notarize, Flex, FlyHomes, Measurabl and Latch, the firm has established itself as a key player in the PropTech space. Camber Creek’s investments target innovative solutions that address critical challenges in the real estate industry, such as property management, building operations and sustainability. The firm’s strategic approach and diverse portfolio underscore its commitment to advancing technology within the built environment.

3. Pi Labs (London, United Kingdom)

Founded in 2015, Pi Labs is a London-based venture capital firm specializing in early-stage investments in the real estate technology sector. The firm focuses on supporting founders who are creating a digital and sustainable built environment. Since its inception, Pi Labs has made over 80 investments across three funds in 15 countries, with 13 exits. Notable portfolio companies include LandTech, Plentific and OfficeRnD, which are at the forefront of transforming the real estate industry through technological innovation. Pi Labs’ investment strategy focuses on scalable solutions that address significant challenges in the built world, to foster a more sustainable and efficient future.

4. Concrete VC (London, United Kingdom)

Founded in 2016 and based in London, Concrete VC is a venture capital investor specializing in early-stage investments in the PropTech sector. The firm emphasizes backing innovative start-ups that use technology to innovate and improve the built environment. Concrete VC’s portfolio includes companies such as Disperse, Metrikus and OpenSpace, which are at the forefront of transforming real estate and construction through digital solutions. By providing capital and strategic guidance, Concrete VC aims to drive technological advancements that address challenges in the real estate industry, including sustainability and operational efficiency.

5. Picus Capital GmbH (Munich, Germany)

Founded in 2015 and based in Munich, Picus Capital GmbH is a venture capital firm that actively invests in early-stage PropTech companies worldwide. With a focus on digital transformation in the real estate sector, Picus supports startups that address challenges in property management, construction efficiency, sustainability and tenant experience. The firm’s PropTech portfolio includes innovative companies such as Architrave, an AI-powered document management platform for real estate, and PlanRadar, a leading construction management tool.

Picture Source: Jason Dent

Included information in our list

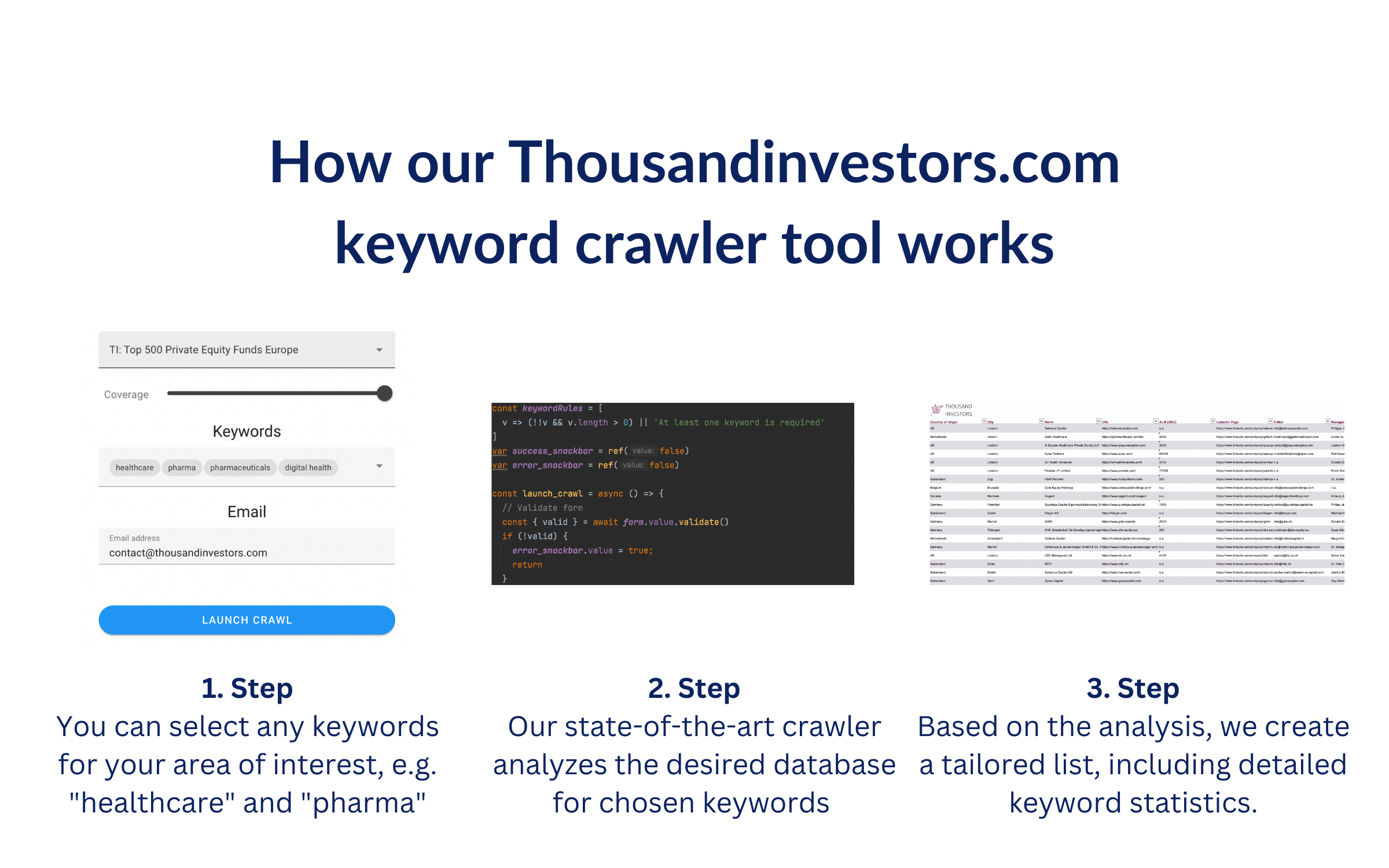

Our keyword analysis-based list include the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 808) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.01) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „proptech“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 1330) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://amavi.capital/2021/investment-platform-amavi-capital-launches-pan-european-proptech-fund-of-eur-60-million/) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.03) – highest keyword rate per subpage

- frequency_per_keyword: {‘proptech’: 1330, ‘real estate’: 0, ‘built environment’: 0, ‘built world’: 0} – dictionary of number of keyword occurrences per keyword

Picture Source: Conny Schneider

Results of our keyword analysis

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

Any questions? Get in touch!

Jan-Erik Flentje, Founder

contact [at] thousandinvestors.com

+49 (0) 89 38466606

We look forward to helping you with any questions, remarks, package prices, and individual requests. Feel free to get in touch via email or phone.

![List of the 250 largest Proptech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Proptech-Investors-List.png)

![List of the 80 largest Vegan Food Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Vegan-Food-Venture-Capital-Investors.png)

![List of the 150 largest Oncology Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Thousand-Investors-Oncology.png)

![List of the 300 largest Cleantech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/CleanTech-Investors-List.png)

![List of the 700 largest Crypto Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/10/Thousand-Investors-Crypto-1.png)

Ricarda Lenglet (verified owner) –

Very good value for money. We bought the list as part of our fundraising and were able to generate many valuable leads.