Description

List of 5 large software venture capital investors

Software has become indispensable in the modern world, with individuals and businesses relying on operating systems and applications to perform everyday tasks. Spending on enterprise software has the highest growth rate in the technology industry. This article highlights five key venture capital firms from our VC list that are interested in the software industry.

1. Khosla Ventures (Menlo Park, USA)

Khosla Ventures, a prominent venture capital firm founded by Vinod Khosla, is known for its investments in innovative technologies, particularly software-driven businesses. The firm actively backs startups that use software to disrupt industries and solve complex problems, from artificial intelligence and cloud computing to data analytics and cybersecurity. Within its portfolio, software-focused companies such as GitLab, a DevOps platform for collaborative software development; Instabase, which provides automation solutions for enterprise workflows; and Okera, a data governance platform for secure and scalable data access, highlight Khosla Ventures’ commitment to advancing transformative technologies.

Update 2024: In October 2024, the company raised $405 million through a special purpose vehicle for OpenAI, the creator of ChatGPT, contributing to OpenAI’s $6.6 billion funding round that valued the company at $157 billion.

2. Balderton Capital (London, United Kingdom)

Balderton Capital is one of Europe’s leading venture capital firms with a strong focus on software investments across multiple sectors. The firm backs companies that use software to disrupt traditional industries and create scalable impact. Examples include Revolut, a fintech software platform redefining banking; Contentful, a leading content management system for digital-first businesses; and Vestiaire Collective, a software-driven platform for pre-owned luxury fashion. Balderton Capital’s portfolio underscores its commitment to backing software startups with global ambitions and groundbreaking visions.

Update 2024: In November 2024, Balderton co-led a historic $160 million Series B funding round for The Exploration Company, a Franco-German space tech startup developing the reusable Nyx cargo capsule.

3. Battery Ventures (Boston, USA)

Battery Ventures is a globally recognised investment firm specialising in growth and innovation across a broad range of industries, with a particular focus on software. The firm invests in companies that are redefining the software landscape, from SaaS and enterprise solutions to cloud-native technologies. Remarkable software-focused companies in its portfolio include Coupa, a leader in corporate spend management; DataRobot, a pioneer in AI-driven enterprise software; and Sprinklr, a unified customer experience management platform.

4. Jazz Venture Partners (San Francisco, USA)

Jazz Venture Partners, based in San Francisco, focuses on technology, science, and humanity to enhance human performance. The firm invests in early and growth-stage companies across enterprise, wellness, healthcare, and consumer markets.

In late 2024, Jazz VP invested in Klowen Braces, an orthodontics company using AI, 3D printing, and modular brackets for more precise and efficient teeth straightening. It also backed Pinpoint Predictive, an insurance platform that applies behavioral economics and big data to help insurers assess hard-to-price risks. These investments reflect Jazz VP’s commitment to transformative innovations.

5. Point Nine (Berlin, Germany)

Point Nine Management GmbH is a venture capital firm specialising in early-stage investments in technology start-ups with a strong focus on Software-as-a-Service (SaaS) and B2B marketplaces. Since its founding in 2008, the firm has backed numerous companies that have revolutionised their industries with innovative software solutions. Notable companies in its portfolio include Algolia, a search-as-a-service platform that delivers fast and relevant digital experiences; Contentful, a leading headless content management system that enables organisations to deliver content across multiple channels; and Mambu, a cloud-based core banking platform that helps financial institutions deliver modern customer experiences.

Picture Source: Markus Spiske

Included information in our list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 1110) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.03) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „software“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 2705) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://www.jmi.com/companies/#WORKFORCE MANAGEMENT) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.08) – highest keyword rate per subpage

- frequency_per_keyword: {‘software’: 274, ‘coding’: 4} – dictionary of number of keyword occurrences per keyword

Picture Source: Ales Nesetril

Results of our keyword analysis

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

Percentage of VC funds that invest in software startups

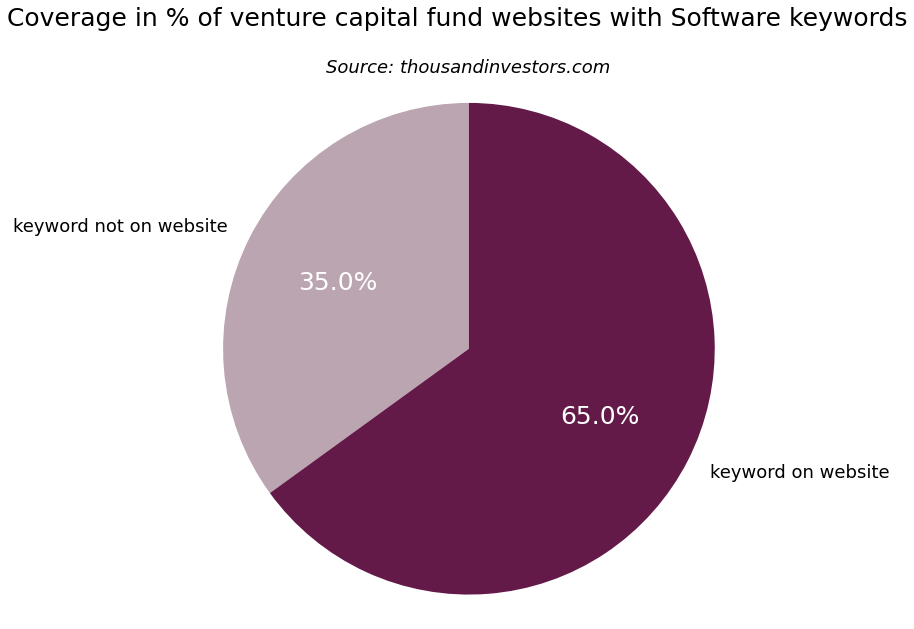

Our keyword crawler analyzed more than 2,500 venture capital funds regarding software investment keywords. We found out that 65.0 % of the global VC funds mention software.

Focus on software

This bar chart shows the most important keywords from our keyword search, however most companies use the keyword software to describe their VC company focus. Additionally, the term coding is used.

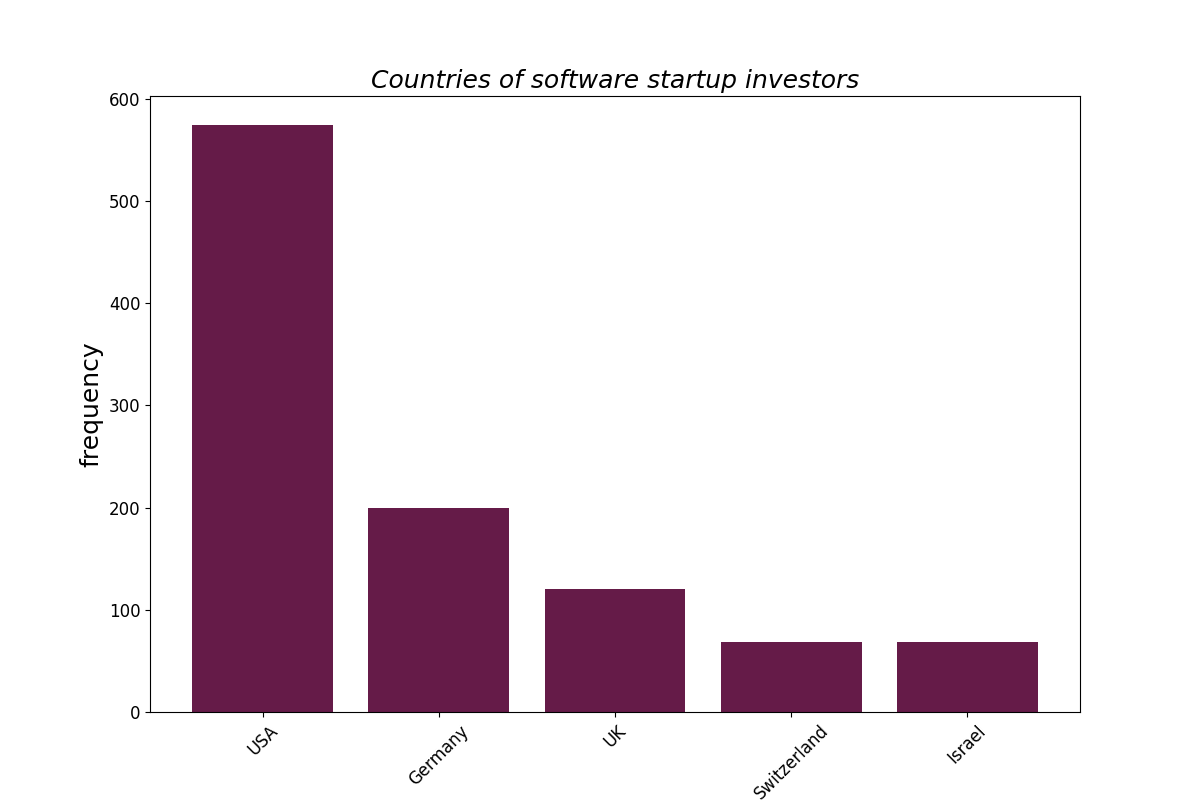

Countries of software startup investors

The most common countries for software startup investors are the USA. For instance, the previously presented investor JMI Equity is located in Baltimore, Maryland. Furthermore, countries like Germany, the UK, Switzerland, and Israel have also many software startup investors. These countries are known for their strong technology industries and high levels of innovation, which makes them attractive locations for startup investors looking for the next big thing. In addition, many of these countries have supportive government policies and favorable tax regimes for businesses, which can help software startups to grow and thrive. As a result, these countries are home to many successful software startups and are popular destinations for investors looking to invest in the technology sector.

Any questions? Get in touch!

Jan-Erik Flentje, Founder

contact [at] thousandinvestors.com

+49 (0) 89 38466606

We look forward to helping you with any questions, remarks, package prices, and individual requests. Feel free to get in touch via email or phone.

![List of the 1,500 largest Software Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Software-Investors-List.png)

![List of the 600 largest Fashion Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Fashion-Investors-List-1.png)

![List of the 900 largest Fintech Startup Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Fintech-Investors-List-1.png)

![List of the 2,500 largest Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Global-VC-Investors-List-2.png)

![List of the 150 largest Oncology Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Thousand-Investors-Oncology.png)

M Schwartz (verified owner) –

Like the other lists we ordered, high accuracy and perfectly matching investors.