Description

![List of the 80 largest Spin-Off Private Equity Investors Europe [2023] List of the 80 largest Spin-Off Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/floriane-vita-FyD3OWBuXnY-unsplash.jpg)

List of 3 large European spin-off-focused private equity funds

1. MCW Capital GmbH (Frankfurt, Germany)

Trigon Equity is a private equity firm that focuses on German mid-cap companies in the industrial, trade, and service sectors. Trigon Equity acquires majorities in companies with revenues ranging from EUR 10 to 150 million in the context of growth, follow-up, and restructuring business cases. Trigon provides hands-on support to these companies in close collaboration with their operational management. The main objective is the sustainable and focused development of the portfolio companies. They are involved in turnaround, spin-off, buyout, and follow-up investments. Their current portfolio includes various companies across different sectors.

2. BPE 4 Unternehmensbeteiligungen GmbH (Frankfurt, Germany)

BPE 4 Unternehmensbeteiligungen GmbH is a private equity firm headquartered in Hamburg, Germany, dedicated to financing Management Buy-outs and, more and more, Management Buy-ins as resolutions to succession difficulties or corporate spin-offs, primarily in the UK SME market. In December 2019, BPE 4 completed its initial round of funding for BPE 4, its fourth investment vehicle, resulting in €122 million being raised. This confirms the company’s active involvement in managing and raising sizable investment funds. The sum obtained demonstrates the corporation’s potential and the confidence investors have in its management and investment approaches.

Update 2024: Since November 2023, the German private equity company has been invested in BAHAMA GmbH. Founded in 1950, our company is a leading provider of high-quality parasols and sun sails.

3. BioMedPartners AG (Basel, Switzerland)

BioMedPartners AG is a venture capital firm based in Basel, Switzerland, specializing in investments in the biotechnology, emerging pharmaceuticals, healthcare, and medical technology sectors. The firm primarily focuses on early-stage and spin-off companies in Switzerland and neighboring European countries. One of their notable achievements is the successful closing of their third equity venture fund, BioMedInvest III, which amounted to 100 million Swiss francs. This fund invests in 12 to 15 biopharmaceutical, medical device, and diagnostics companies, primarily in Switzerland and neighboring countries.

Picture source: Unsplash

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds help to get in touch with the executives and investment managers of the included firms.

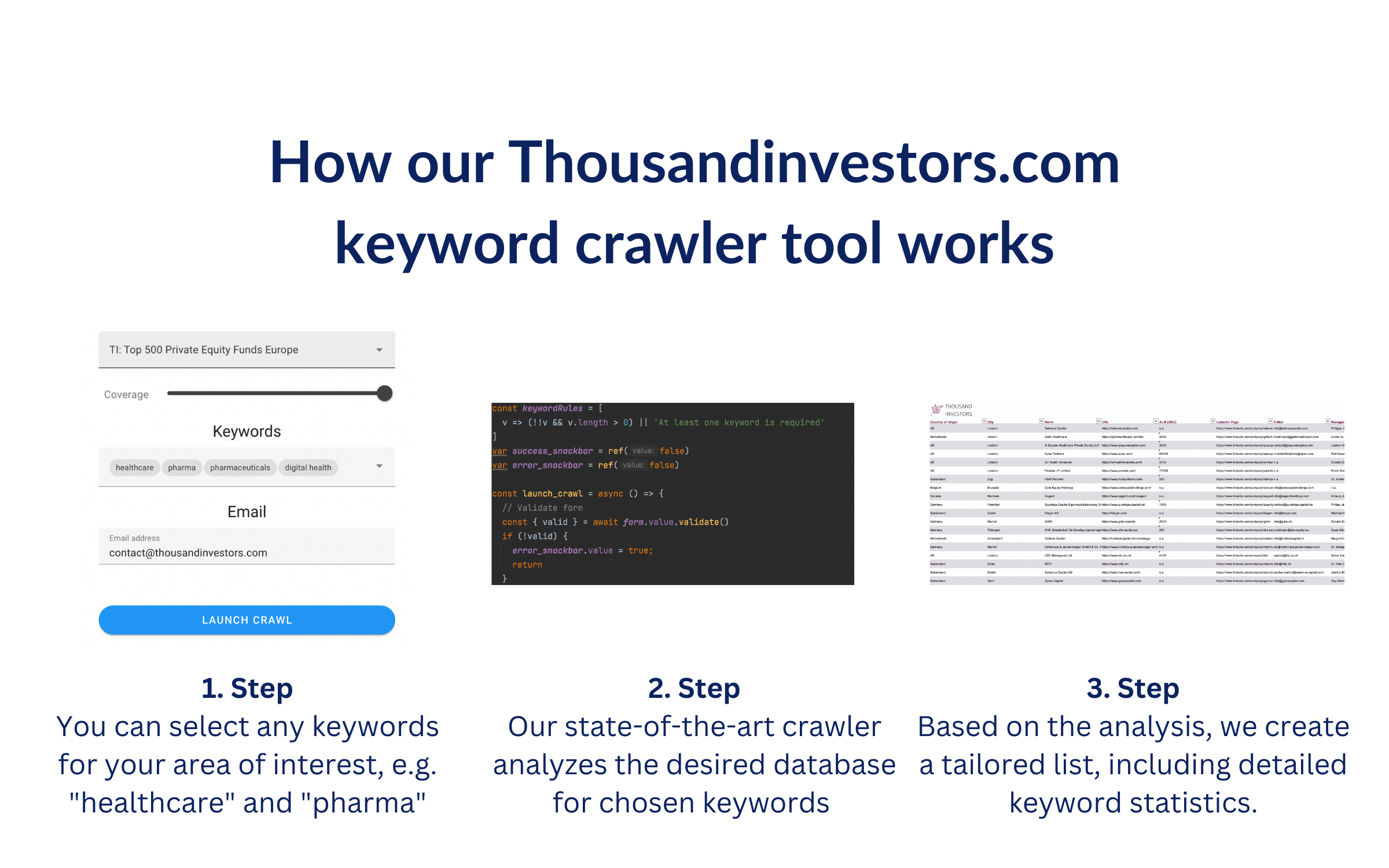

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keywords “Spin-Off“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords were found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 80 largest Spin-Off Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Spin-Off-Private-Equity-Investors.png)

![List of the 80 largest Spin-Off Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Spin-Off-Private-Equity-Europe.png)

![List of the 300 largest Infrastructure Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Infrastructure-Private-Equity-Investors.png)

![List of the 40 largest Hydrogen Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/11/Hydrogen-Private-Equity-Investors.png)

![List of the 90 largest Buy-and-Build Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Buy-and-Build-Private-Equity-Investors.png)

![List of the 30 largest Private Equity Funds in Sweden [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Sweden.png)

Reviews

There are no reviews yet.