Description

![List of the 150 largest Sports Private Equity Investors Europe [2023] List of the 150 largest Sports Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/tim-gouw-VvQSzMJ_h0U-unsplash-scaled.jpg)

List of 3 large European sports-focused private equity funds

Private equity investment in the sports sector focuses on businesses with high growth potential, including professional teams, sports technology, fitness brands, sporting goods and media companies. Below, we present three private equity firms with a dedicated focus on the sports sector.

1. CVC Capital Partners (Luxembourg, Luxembourg)

CVC Capital Partners, headquartered in Luxembourg, is a global private equity firm with over $100 billion of assets under management across a range of industries. Founded in 1981, CVC is known for its strategic focus on high-growth sectors, leveraging its global network to create long-term value. In sports, CVC has made significant investments in world-class assets such as Formula One, Six Nations Rugby and the Women’s Tennis Association (WTA). These acquisitions reflect CVC’s strategy to capitalise on the growing value of media rights, sponsorship and commercialisation in professional sport. By combining financial resources with strategic expertise, CVC is enhancing the fan experience, driving global expansion and optimising revenue streams to shape the future of the sports industry.

Update 2024: In April 2024, CVC further strengthened its market position by raising $2.1 billion through an initial public offering, valuing the company at up to $16 billion.

2. BC Partners (London, United Kingdom)

London-based BC Partners is a prominent private equity firm with a growing interest in sports-related investments. The firm recently entered into exclusive discussions to acquire a minority stake in the EuroLeague, Europe’s premier basketball competition, which is valued at approximately €1 billion. This potential investment underscores BC Partners’ focus on high-profile sports properties with strong fan bases and global appeal. By combining its financial expertise with strategic insight, BC Partners seeks to unlock value in the sports ecosystem and capitalise on growing revenues from sponsorship, merchandising and media rights.

3. Charterhouse Capital Partners (London, United Kingdom)

Charterhouse Capital Partners, a UK-based private equity firm, has expanded its portfolio to include investments in sports and sports-related businesses. One of its key acquisitions is Two Circles, a data-driven sports marketing agency that helps organisations improve fan engagement and commercial performance. Two Circles’ clients include high-profile organisations such as the English Premier League and Wimbledon. Charterhouse uses its financial resources and strategic guidance to enable sports organisations to optimise their operations and maximise revenue streams, underlining its commitment to innovation and growth in the sports industry.

Picture source: Unsplash

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds help to get in touch with the executives and investment managers of the included firms.

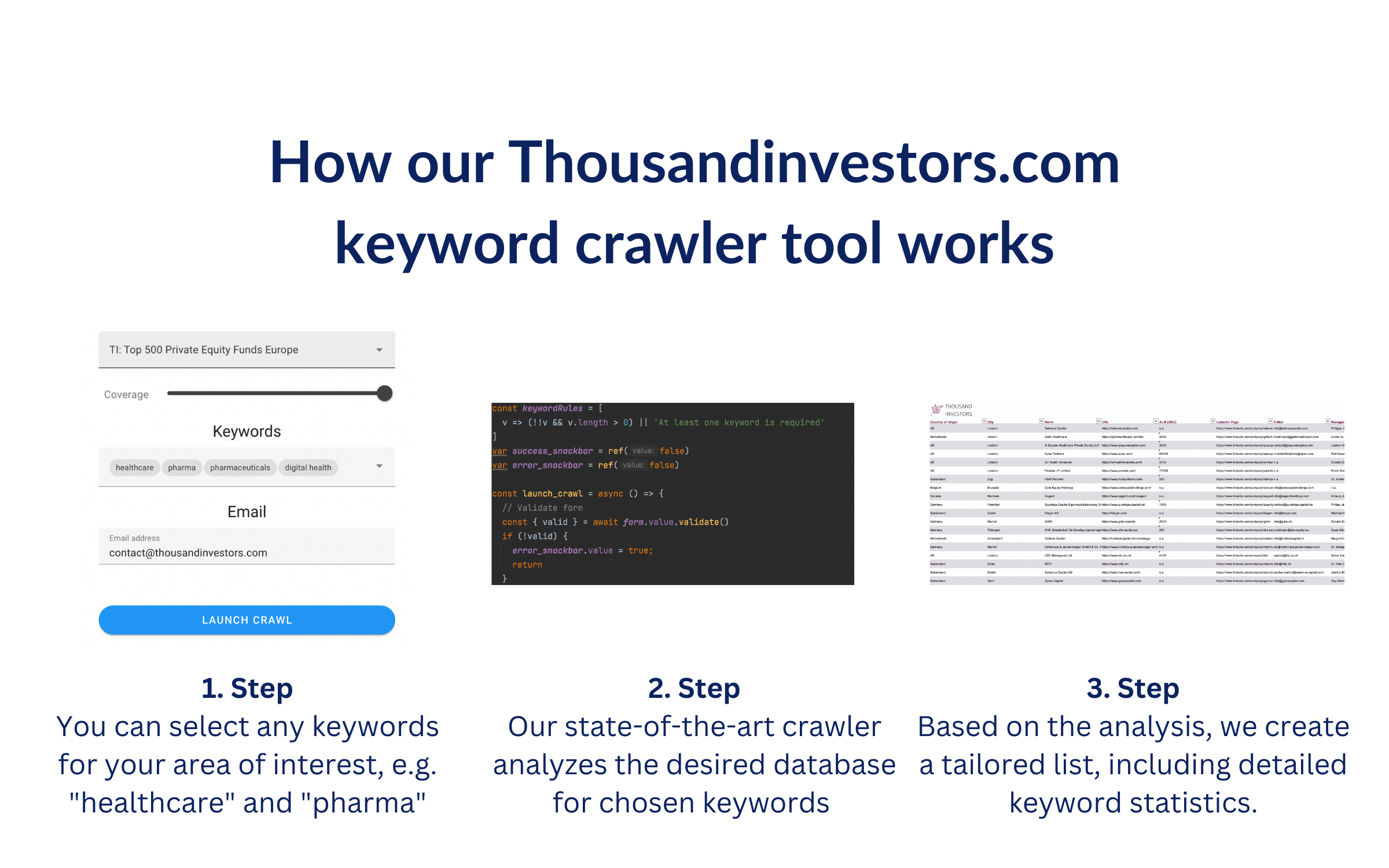

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “sports“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords were found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 150 largest Sports Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Sports-Private-Equity-Investors.png)

![List of the 150 largest Sports Private Equity Investors Europe [Update 2025] - Image 2](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Sports-Private-Equity-Europe-1.png)

![List of the 190 largest Private Equity Funds UK [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-UK.png)

![List of the 40 largest Hydrogen Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/11/Hydrogen-Private-Equity-Investors.png)

![List of the 60 largest Industrial Technology Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Industrial-Technology-Private-Equity-Investors.png)

![List of the 90 largest Carve-Out Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Carve-Out-Private-Equity-Investors.png)

Reviews

There are no reviews yet.