Description

List of 5 large tech venture capital investors

The technology industry is defined essentially as the research, development, and distribution of technologically based products and services. The sector is often focused on electronics, software, and applications. This article highlights five large tech venture capital investors that are actively engaged in the industry.

1. Accel (Palo Alto, USA)

Accel is a leading global venture capital firm focused on early-stage and growth investing. Founded in 1983 in Palo Alto, California, Accel has been instrumental in the success of many iconic technology companies, including Facebook, Dropbox, Slack, Atlassian, and Spotify. The firm has a global footprint, with offices in Silicon Valley, London and Bangalore, enabling it to tap into vibrant startup ecosystems worldwide. Accel focuses on partnering with visionary founders in sectors such as software, consumer internet, enterprise IT and fintech. Its investment strategy is to support companies from seed to scale, providing not only capital, but also guidance, access to networks and operational expertise.

Update 2024: In 2024, Accel raised a remarkable $650 million for its Accel London VIII fund, which aims to support early-stage startups across Europe and Israel.

2. New Enterprise Associates (Menlo Park, USA)

New Enterprise Associates (NEA) is one of the world’s largest and most influential venture capital firms, focused on empowering founders to build transformational companies across multiple industries. Founded in 1977, NEA has been a committed partner for nearly five decades, providing stability, strategic guidance and hands-on collaboration throughout a company’s growth journey. The firm invests at all stages of a company’s lifecycle, from seed to IPO, with a portfolio that spans sectors including technology, healthcare and consumer services. NEA has been instrumental in scaling companies that have reshaped industries such as Salesforce, Robinhood and Workday, demonstrating its ability to identify and support disruptive ideas.

3. Atomico (London, United Kingdom)

Atomico, founded in 2006 and headquartered in London, is an international investment firm that aims at the global scaling of disruptive technology companies. With $5 billion assets and 100+ strategic partnerships, Atomico has been instrumental to the success of Klarna, one of the leading fintech firms in Sweden which focuses on successful deal clearings and online financial services through their platform, and Skype, the telecommunications platform that revolutionized the industry.

4. Earlybird Venture Capital (Berlin, Germany)

Earlybird Venture Capital is a prominent European venture capital firm based in Berlin that focuses on early-stage investments in high-growth technology companies. The firm primarily targets sectors such as SaaS, digital health, AI and other transformative industries. Earlybird’s portfolio includes notable companies such as N26, a leading digital bank in Europe, and Kry, a telemedicine platform rapidly expanding across Europe. Other key investments include Sennder, a digital freight forwarding company, and Delivery Hero, a global food delivery giant.

5. Ventech (Paris, France)

Ventech is a leading European venture capital firm specialising in backing innovative start-ups in sectors such as digital media, e-commerce and software services. With offices in Paris, Munich and Helsinki, the firm operates internationally, supporting entrepreneurs with capital and strategic expertise to help them scale globally. Ventech has raised over €900 million across multiple funds and has built a diverse portfolio of high-potential companies. Notable investments include Veo, a leader in sports AI technology, Ogury, a mobile travel marketing platform, and Mindler, a digital therapy provider.

Picture Source: Umberto

Included information in our list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 4039) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.05) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „tech“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 2937) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://www.veloquence.capital/invest-in-startups/#mobile-menu) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.06) – highest keyword rate per subpage

- frequency_per_keyword: {‘tech’: 1456, ‘technology’: 2937} – dictionary of number of keyword occurrences per keyword

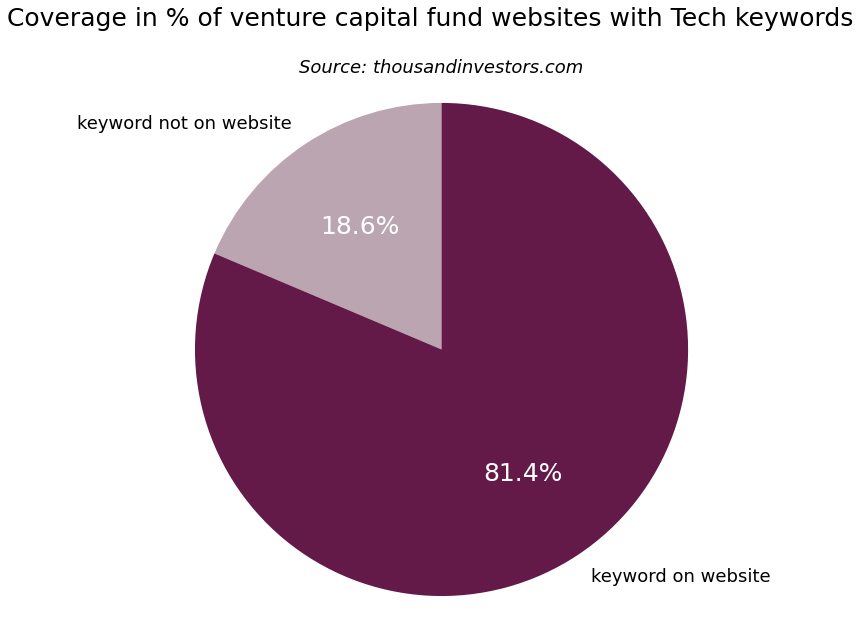

Picture Source: Ilya Pavlov

Results of our keyword analysis

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

Percentage of VC funds that invest in start-ups in the tech sector

Our keyword crawler analyzed more than 2,500 venture capital funds regarding tech investment keywords. We found out that 81.4 % of the global VC funds mention technology.

Focus on technology and tech

This bar chart shows the most important keywords from our keyword search, however most companies use the keyword technology to describe their vc company focus. Additionally, the term tech is used.

Any questions? Get in touch!

Jan-Erik Flentje, Founder

contact [at] thousandinvestors.com

+49 (0) 89 38466606

We look forward to helping you with any questions, remarks, package prices, and individual requests. Feel free to get in touch via email or phone.

![List of the 2,000 largest Tech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Tech-Investors-List.png)

![List of the 1,000 largest SaaS Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/SaaS-Investors-List.png)

![List of the 600 largest Fashion Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Fashion-Investors-List-1.png)

![List of the 1,000 largest Food Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Food-Investors-List-1.png)

![List of the 1,000 largest EdTech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Edtech-Investors-List.png)

Edmund (verified owner) –

Probably the most extensive and most up-to-date version of tech investors. Only a few points of information, but perfectly suitable for mailing campaigns and fundraising processes.