Description

![List of the 60 largest Industrial Technology Private Equity Investors Europe [2023] List of the 60 largest Industrial Technology Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/sergey-zolkin-_UeY8aTI6d0-unsplash-scaled.jpg)

List of 3 large European industrial-technology-focused private equity funds

European private equity funds focused on industrial technology represent a specific segment within the broader private equity market. They target companies operating at the intersection of industrial sectors and technological innovation. These funds typically invest in companies operating in traditional industrial sectors such as manufacturing, automotive, aerospace, and energy, but with a strong emphasis on technological innovation. This may involve advanced manufacturing technologies, industrial automation, digital transformation, IoT, and AI applications in industrial settings.

1. 3i Group plc (London, United Kingdom)

3i Group plc is an international investment manager headquartered in London, with a focus on private equity and infrastructure. The company is known for investing in various sectors, including industrial technology. In private equity, 3i Group often invests in mid-market companies across Europe, North America, and Asia. The investment firm actively seeks investment opportunities in companies that are at the forefront of technological innovation and efficiency in the industrial sector. This includes firms involved in advanced manufacturing processes, automation, digitalization, and sustainable industrial practices.

Update 2024: In 2023, the London-based private equity firm 3i Group supported the acquisition of Personify. Personify is located in North Carolina and is recognized for its high-quality services, client-focused approach, and flexible delivery model in sectors such as life sciences, pharmaceuticals, biotechnology, and healthcare.

2. PINOVA Capital GmbH (Munich, Germany)

PINOVA Capital is a private equity firm based in Munich. They specialize in investing in high-growth Mittelstand companies in the industrial technology and information technology sectors in German-speaking regions. Established in 2010, the firm currently manages over €450 million in assets. One of their significant investments is in VTI Ventil Technik GmbH, a global leader in mission-critical high-pressure valves and regulators. This investment was made in collaboration with NRW.BANK, aims to accelerate VTI’s growth in new regions and application areas.

3. Clayton, Dubilier & Rice, LLC (New York, United States)

Clayton, Dubilier & Rice, LLC is a private investment firm located in New York, United States. The company has a worldwide presence, with locations in New York and London. It has overseen the investment of over $30 billion in 93 companies, with a combined transaction value exceeding $140 billion. CD&R made a significant investment in industrial technology by acquiring Epicor Software Corporation from KKR in August 2020 for $4.7 billion. Epicor provides industry-specific enterprise software to manufacturing, distribution, retail, and service sectors worldwide.

Picture source: Unsplash

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds help to get in touch with the executives and investment managers of the included firms.

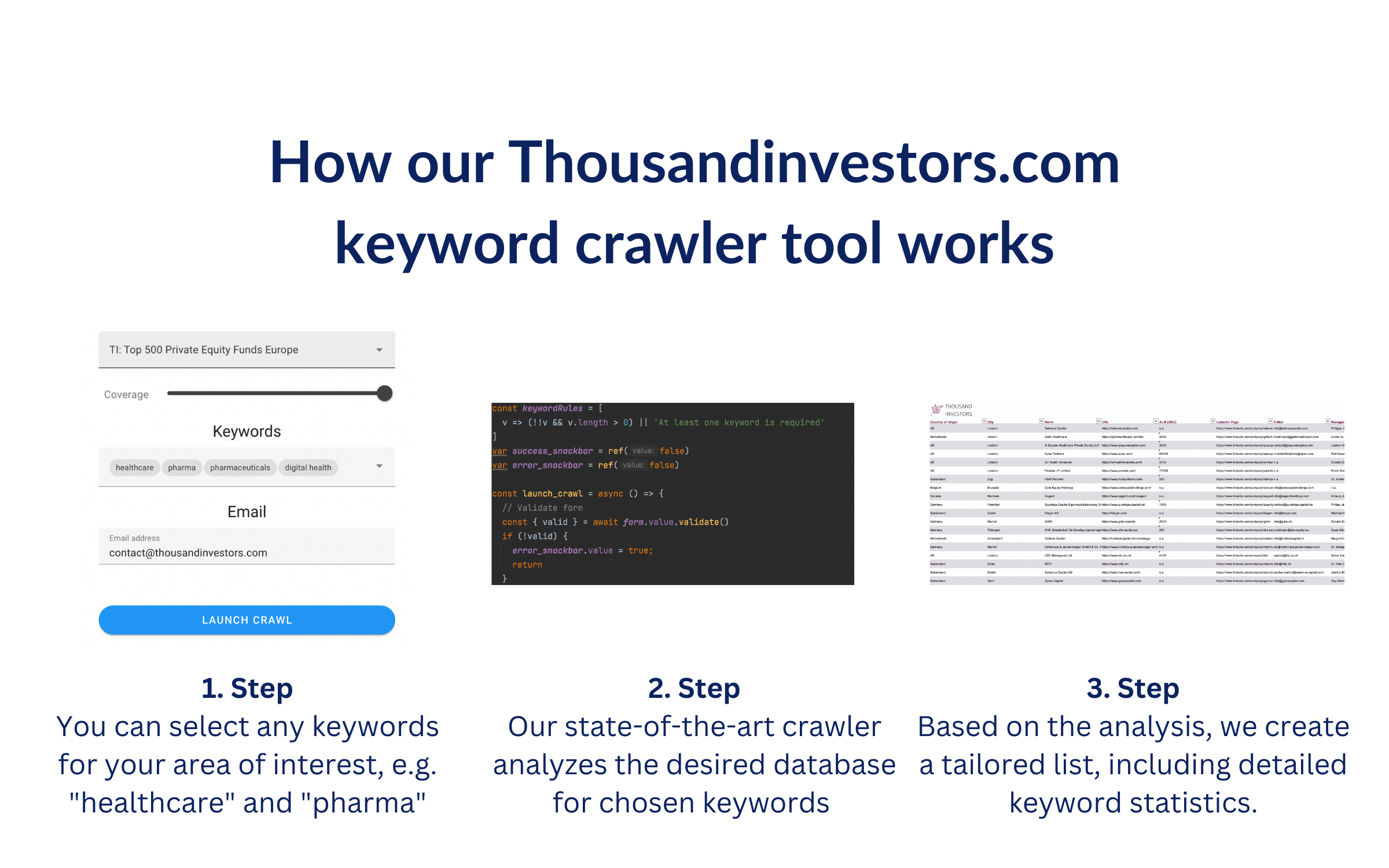

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keywords “industrial technology, industrial services, engineering technology, manufacturing technology“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords were found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 60 largest Industrial Technology Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Industrial-Technology-Private-Equity-Investors.png)

![List of the 60 largest Industrial Technology Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Industrial-Technology-Private-Equity-Europe.png)

![List of the 30 largest Private Equity Funds in Sweden [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Sweden.png)

![List of the 190 largest Private Equity Funds UK [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-UK.png)

![List of the 40 largest Private Equity Funds in the Netherlands [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Netherlands.png)

![List of the 140 largest Succession Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Succession-Private-Equity-Investors.png)

Reviews

There are no reviews yet.