Description

List of 3 large Vegan Food Startup Investors

Recently, the demand for plant-based meat, dairy, and egg alternatives has skyrocketed and more sustainable replacements are developed and created daily. In this article, we highlight three interesting vegan food venture capital investors from our keyword-crawler-based vegan food venture capital investor list.

1. Veg Capital (UK)

Veg Capital is a UK-based vegan food venture capital investor that funds early-stage companies that aim to replace animal products with plant-based alternatives in the food system. In particular, the company invests in meat, dairy, egg, and seafood replacements for conventional animal products. Their portfolio includes the company VFC, which works on creating inexpensive meat alternatives, and Mighty Pea, which creates a sustainable and dairy-free alternative to milk.

2. Green Circle Foodtech Ventures (USA)

Green Circle Foodtech Ventures, a venture capital division established in 2019 by Green Circle Capital Partners, is headquartered in New York City. The firm’s investment focus is on sustainable food technologies, encompassing the domains of alternative proteins, fermentation, food safety, shelf-life extension, automation in food production, bioplastics, sustainable packaging, and plant-based ingredients. Noteworthy investments have been made by GCFV in the vegan food sector within the past 12 months. Notably, in July 2024, GCFV participated in a seed funding round for Uncaged Innovations, a company specialising in synthetic textiles, and earlier in February 2024, GCFV invested in Mondra, a company offering business and productivity software solutions with a focus on sustainability.

3. ASIF Ventures (Netherlands)

ASIF Ventures, a student-centric venture capital fund based in the Netherlands, has demonstrated its commitment to sustainable food innovation with recent investments. Recently, the firm participated in a pre-seed funding round for VaVersa, an Amsterdam-based company specialising in indoor gardens. VaVersa’s flagship product, MIA, is a vertical farming solution that enables chefs to cultivate over 80 varieties of microgreens and herbs on-site, promoting hyperlocal and ultra-fresh ingredients. This not only reduces reliance on wholesalers but also minimises food waste and environmental impact by eliminating pesticides and single-use plastics. Additionally, the system uses 95% less water than traditional agriculture methods and significantly cuts carbon emissions associated with food transportation.

Picture source: Ralph (Ravi) Kayden

Included information list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

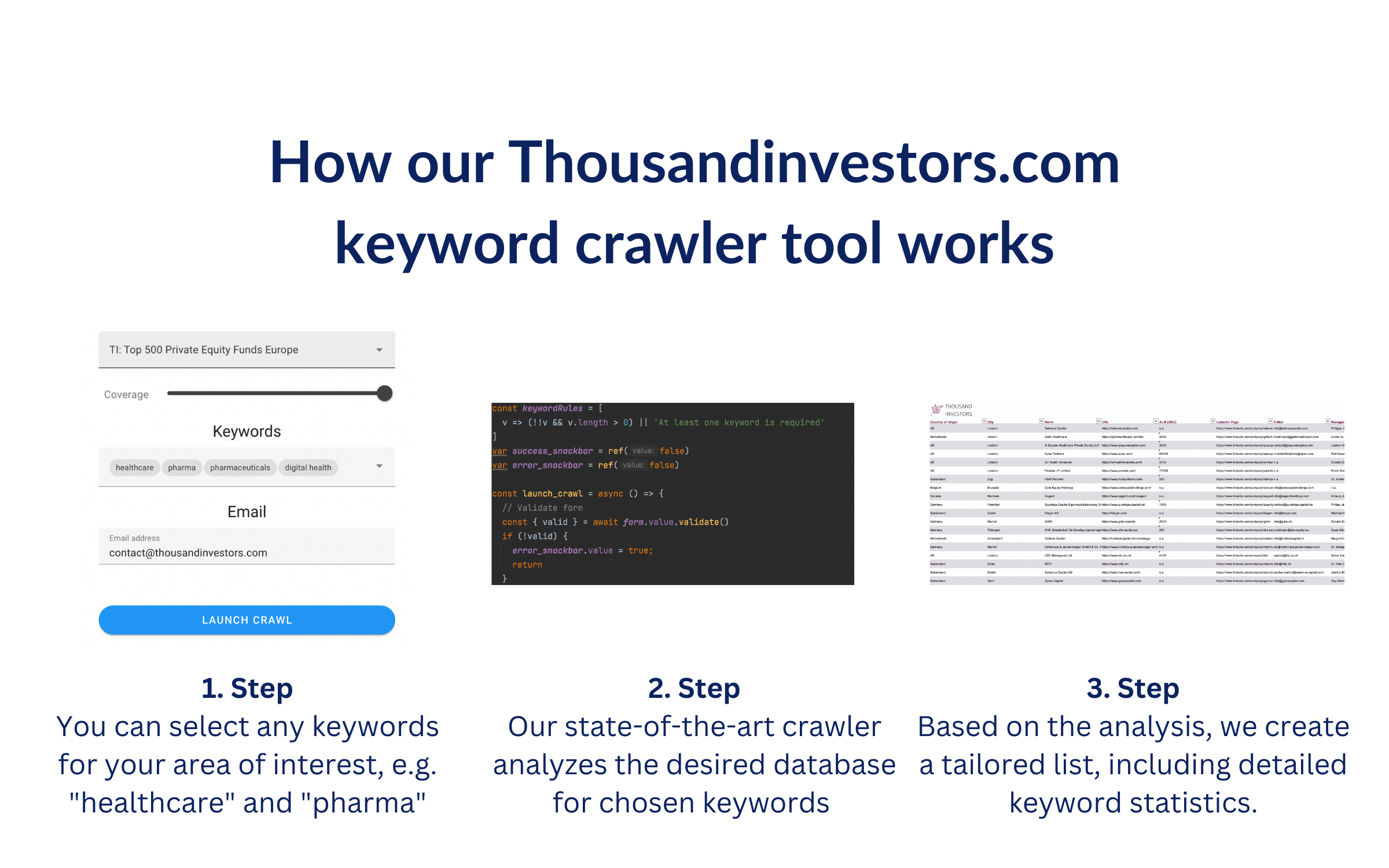

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 16) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.008) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „vegan“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 36) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://vegcapital.co.uk/portfolio/) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.04) – highest keyword rate per subpage

- frequency_per_keyword: {‘vegan’: 36, ‘plant based’: 0, ‘plant based foods’: 0, ‘meatless’: 0, ‘meat alternative’: 0, ‘soy meat’: 0, ‘seitan’: 0, ‘tofu’: 0, ‘pea protein’: 0} – dictionary of number of keyword occurrences per keyword

Picture Source: Brooke Lark

![List of the 80 largest Vegan Food Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Vegan-Food-Venture-Capital-Investors.png)

![List of the 900 largest Mobility Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Mobility-Investors-List.png)

![List of the 500 largest Gaming & Esports Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Gaming-eSports-Investors-List.png)

![List of the 700 largest Crypto Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/10/Thousand-Investors-Crypto-1.png)

![List of the 100 largest Immunology Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Immunology-VC-Investors-List.png)

Frédéric Meyer (verified owner) –

We were not aware that there were so many specialized venture capital funds for (vegan) food. Great list